Gold (XAU/USD) traded on a bullish sentiment through the mid-European session on Monday, as investors rode on the massive gains in the silver (XAG/USD) market. However, gold remained confined within last week’s highs amid a goodish bounce in the US dollar, which tends to undermine demand for the dollar-denominated commodity.

Gold remained range-bound for the seventh consecutive session as investors anticipate new developments around a US stimulus package.

Futures contracts for silver saw a spike in the early trading hours on Monday as Reddit retail investors appear to have shifted their focus to the metal markets. The short squeeze saw spot silver rise by about 11% to a new 8-year high of $30.18/ounce earlier today.

If this rally holds, it would be the largest one-day spike in the commodity since a 13% spike in March 2009. Silver briefly claimed the $30.18 high on OANDA to record its highest ever point since February 2013 (exactly eight years ago) before reeling to the mid-$29 level. Meanwhile, the boom got reflected in silver-related equities late last week.

That said, gold’s relatively subdued standing amid the 11% spike in silver alludes that the rally may not be sustainable. At the moment, an ounce of gold can buy 63.5 ounces of silver, compared to 73.3 ounces in January.

Soni Kumari, a commodity strategist at ANZ, noted that “given the gold-silver ratio is at a multi-year low, we see limited room for further outperformance of silver.”

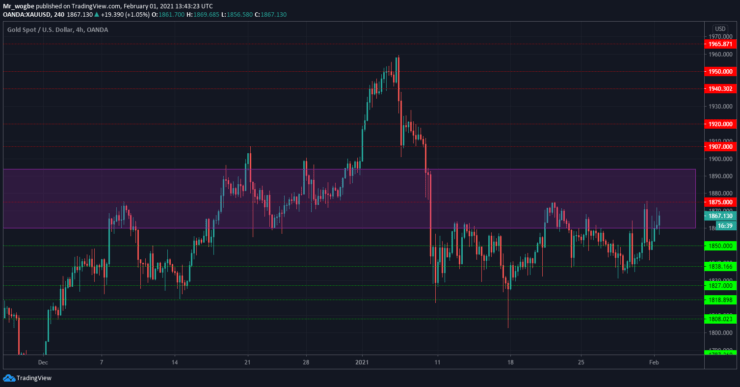

Gold (XAU) Value Forecast — February 1

XAU/USD Major Bias: Bullish

Supply Levels: $1875, $1890, and $1900

Demand Levels: $1860, $1850, and $1838

Although gold began this week on a goodish bounce, it is yet to confirm a bullish momentum for traders. A sustained break above the $1875 resistance should open the door for buying for the yellow metal, which could send it to the $1900 psychological resistance in the coming days.

Failure to clear this resistance level could reinstate gold’s previous bearish sentiment and send it to the $1830 area once again.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.