Some bearish comments came from the Fed today after Bostic said that economic recovery is happening but at a slow pace. Also, Fed’s Clarida shed more light on the Fed’s stance noting that “unemployment rate by itself and in the absence of inflation will not be a sufficient trigger for a rate hike.” If this stance remains unchanged at the Fed meeting in September, then gold could see further gains.

Meanwhile, the early optimism over the goodish Chinese PMI data for August has faded from the market rather quickly. This can be seen in the sharp turnaround in the global risk appetite, which has bolstered demand for gold in the near-term. The anti-risk sentiment was strengthened by a slight intraday pullback in the US Treasury bond yields.

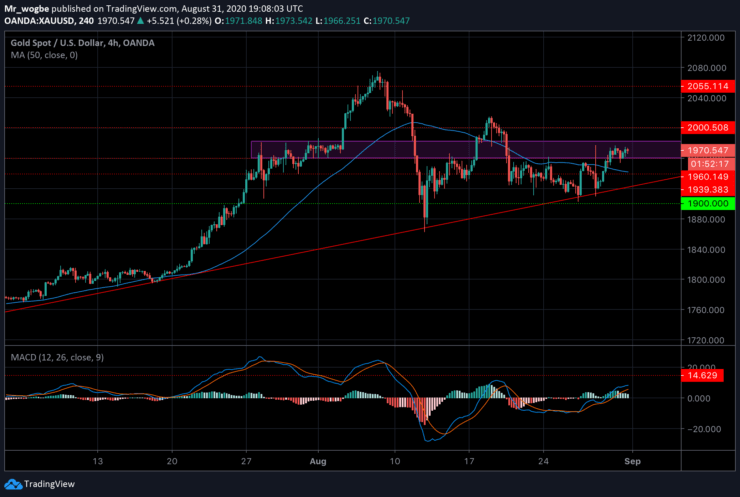

However, despite the favorable conditions, the uptick seen in gold lacked the strength to follow-through, and bulls are not yet convinced. That said, it would be wise to wait for a strong break above the $1977 supply region before expecting any significant bull rally.

Gold (XAU) Value Forecast — August 31

XAU/USD Major Bias: Sideways

Supply Levels: $1977, $1983, and $2000

Demand Levels: $1940, $1923, and $1909

Gold remained well within our pivot region ($1983-60) as stipulated in this morning’s analysis. Meanwhile, it is appearing more and more likely that bulls, rather than bears, will win this bout. That said, a bullish breakout is to be expected in the near-term as upwards appears to be the “path of least resistance” currently.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.