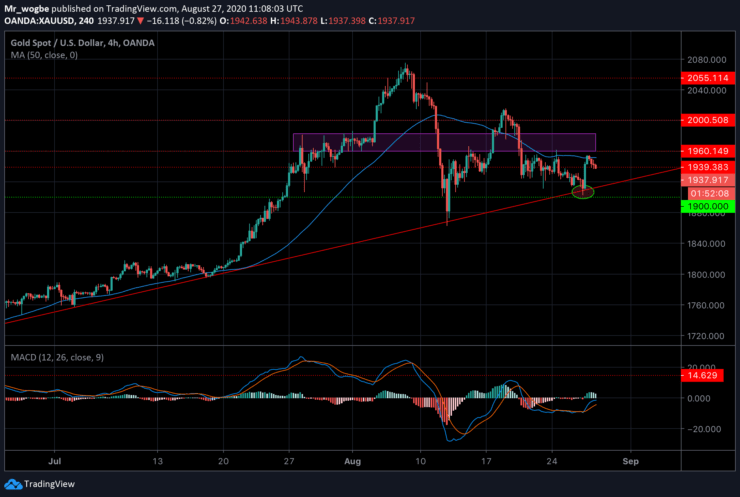

The yellow metal failed to facilitate a strong-follow through momentum from yesterday’s impressive bounce from the $1900 area, two-week low and was met with fresh supply on Thursday. The supply influx was most likely due to the 4-hour 50 SMA at the 1953 area.

However, the highly-anticipated Fed event has restrained investors from becoming aggressively bullish or bearish, which has kept gold in a consolidated state. The expectation of a dovish Fed outlook in the event has kept the US dollar (DXY) in a defensive mode, which has extended some support to the dollar-denominated commodity.

Also, the softer risk tone across markets has kept demand for the safe-haven asset. The risk-off sentiment was bolstered by the fresh leg down in the US Treasury bond yields, which might prevent further downside movement for the non-yielding commodity in the near-term. That said, investors will be waiting to see a significant rally before getting involved.

Moving on, market participants will be looking at the US economic docket today—which features the preliminary US GDP report and the Jackson Hole Symposium—for clues. Investors will be fixated on the Fed Chair Jerome Powell’s speech at the event for the next course of action.

Gold (XAU) Value Forecast — August 27

XAU/USD Major Bias: Sideways

Supply Levels: $1953, $1960, and $1983

Demand Levels: $1923, $1909, and $1900

Just as we projected in the last analysis, gold has bounced off the ascending trendline around the $1908 level, indicating that this line will continue to ‘help’ the commodity on its journey higher. It is expected that the precious metal will remain consolidated between the $1935 and the $1955 levels in the near-term as markets brace for the Symposium scheduled for two hours from press time.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.