Gold (XAU/USD) experienced another brutal beating in the early European session on Thursday as the commodity fell to a daily low of $1,926 courtesy of the fresh bull run in the US dollar (DXY).

The greenback was met with strong demand across the board following the central bank’s announcement that they planned on scaling back the dollar repository as the Coronavirus pandemic-induced market crisis eases.

The yellow metal is struggling to recover from yesterday’s drop to $1,927 as the dollar took advantage of the post-FOMC market influence despite the weakness around the US Treasury bond yields.

Meanwhile, the risk-averse market tone amid uncertainty over the US economic recovery remains a source of support for the precious metal ahead of the US Jobless Claims data scheduled for release later today.

The renewed Sino-US trade optimism appears to be a barrier for further upside swings in gold. A recent Bloomberg report cites that both countries are planning on resuming delayed trade talks.

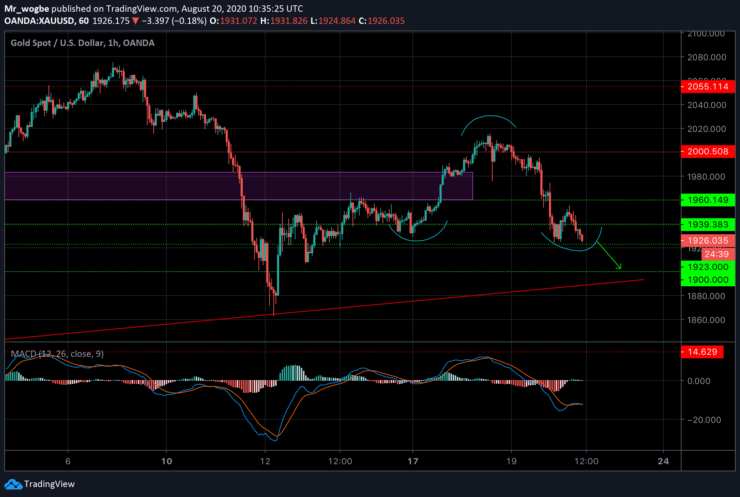

Gold (XAU) Value Forecast — August 20

XAU/USD Major Bias: Bearish

Supply Levels: $1,939, $1,9,60, and $1,983

Demand Levels: $1,923, $1,900, and $1,890

According to our hourly chart, a head-and-shoulders pattern is beginning to take shape, indicating a fresh bearish pattern. If bulls fail to defend the $1,923 key support, we could see yet another sell-off that could take gold down to the $1,900 psychological line. The last line of defense for bulls will be the $1,890 level, which is the base of our prevailing trendline. Further declines could see the August 12 low ($1,862) come into play.

On the flip side, a good defense of the $1,923 level could help gold facilitate a bounce to the $1,939 resistance and the $1,960 pivot level again.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.