The yellow metal failed to take advantage of yesterday’s intraday bounce from a low of $1,757 following the positive US monthly jobs report. The NFP report showed that the US created 4.8 million jobs in June, surpassing analysts’ expectations by 1.8 million. Also, the unemployment rate dropped to 11.1% from 13% in May.

Furthermore, China released an upbeat Caixin Services PMI in the early Asian session on Friday, reaching its highest point since April 2010. These positive economic data renewed investors’ hope for a V-shaped global economic recovery.

This comes on the heels of fresh optimism over a potential vaccine for the Coronavirus which extended support for a risk-on market tone. The renewed risk-on sentiment undermined demand for safe-haven assets and prevented gold from making any significant gain.

However, the ever-increasing number of Coronavirus cases across the globe and concerns over the possible renewal of lockdown restrictions has kept the overall market sentiment gloomy. This coupled with the continuing selloff of the USD has extended further support to gold.

Meanwhile, markets will likely not be very active today considering the holiday in the US. That said, we will likely remain in a consolidation range for the majority of today.

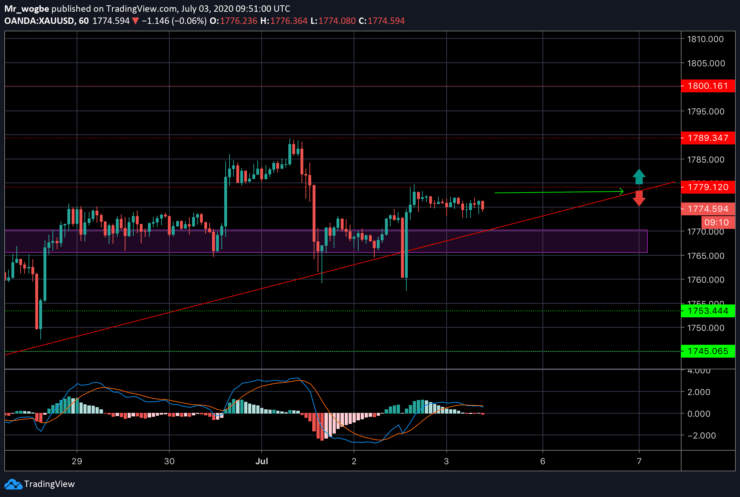

Gold (XAU) Value Forecast — July 3

XAU/USD Major Bias: Sideways

Supply Levels: $1,779, $1,790, and $1,800

Demand Levels: $1,765, $1,758, and $1,745

As mentioned above, we are likely to end the week in a consolidative range, considering that the US is on holiday. However, a breakout in price (either to the upside or downside) in the near-term is not off the table, considering that we are nearing a wedge. A fall from this level will likely provide a further bounce for gold as we keep the $1,800 price in focus.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.