The greenback witnessed a strong bullish rally at the end of last week following a better-than-expected US monthly jobs report. A weakened USD price action was believed to be one of the key supports for the yellow metal, however, the prevalent risk-on market sentiment has capped any strong gains for gold.

The ever-growing optimism for a sharp V-shaped global economic recovery, coupled with the outlook that the worst of the pandemic has passed continues to fuel a risk-on mood in the market. This, consequently, is reducing the demand and safe-haven appeal of gold and is holding bulls from becoming aggressive.

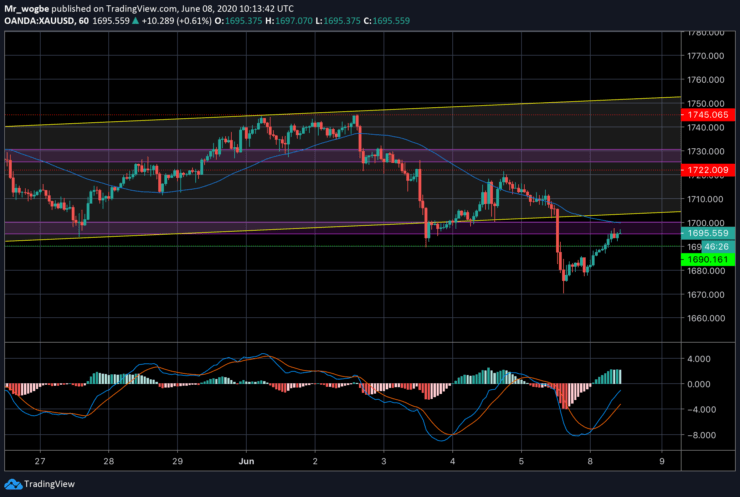

Gold (XAU) Value Forecast — June 8

XAU/USD Major Bias: Sideways

Supply Levels: $1,700, $1,710, and $1,717

Demand Levels: $1,690, $1,677, and $1,670

Gold (XAU/USD) broke below our ascending trend-channel and proceeded to break our key support at $1,700 after Friday’s unemployment data showed better-than-expected results. This immediately put gold in a bearish light forcing it to break through many support levels. Thankfully, the $1,670 support remained unabashed and has served as a bounce for the price to approach the $1,700 level.

Bulls are now faced with the task of sending the gold price above that pivot line up to $1,710 at least before we can see any further gains. Failure to capture the $1,700-10 level in the coming hours could send the price back to the $1,670 key support. A break below that level could catalyze further declines.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.