Investors continue in their worry over the pandemic-induced economic crisis and the dwindling prospects of a sharp recovery. This has largely favored the yellow metal in securing its footing above the $2,000 mark.

Market concerns were stoked further by yesterday’s worse-than-expected ADP report, which indicates that the labor market might not be recovering anytime soon. This coupled with the political stalemate over the next round of fiscal stimulus packages has put intense pressure on the US dollar, which in turn provided additional support for the dollar-denomination commodity.

Furthermore, the prevailing decline in the US Treasury bond yields drove extra demand for the non-yielding commodity. The 10-year US government bond recorded a fresh record low on Tuesday.

Nonetheless, strong risk-on sentiment in the equity markets and the overbought conditions surrounding gold has caused the asset to stall, which has prompted some profit-taking.

Moving on, market participants will be looking at the US economic docket today—which features the US Initial Weekly Jobless Claims—for clues. This report could present some short-term trading opportunities as the markets gear-up for the NFP release, scheduled for tomorrow.

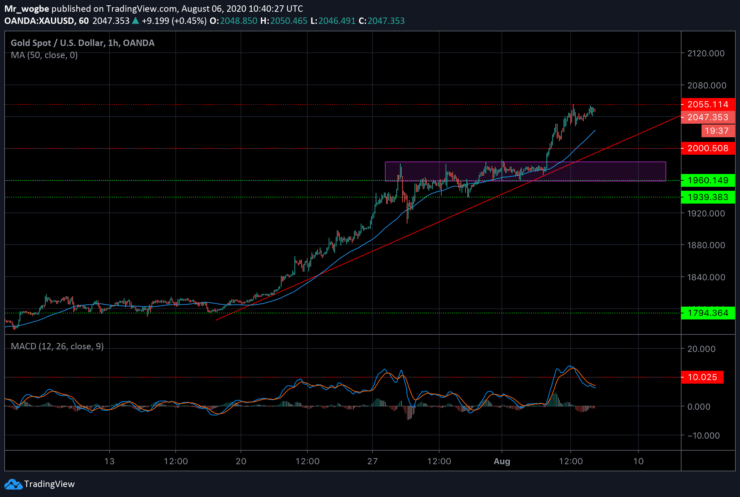

Gold (XAU) Value Forecast — August 6

XAU/USD Major Bias: Bullish

Supply Levels: $2,055, $2,060, and $2,080

Demand Levels: $2,010, $2,000, and $1,980

Gold is being relentless in its stride for gains as it has now reached the previous target ($2,050) causing buyers to shift their focus to $2,100.

However, as mentioned above, we could experience some profit-taking in the near-term, which could prompt gold to witness a modest retrace. That said, the path downwards is well fortified with several support levels (50HMA, trendline, and $2,000 psychological support).

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.