Gold has managed to stage a decent recovery despite the increased safe-haven demand for the USD amid rising US-China and Australia-China tensions.

Meanwhile, a new development in France that the Finance Ministry has announced a state of emergency for the Aerospace industry has ruffled investors causing European equities to drop which, consequently, has allowed the yellow stage a steady rebound.

However, hopes for further recovery for gold in the near term look very dim as the USD is likely to extend its safe-haven appeal considering that there are expectations of an optimistic economic outlook likely to be announced by the Fed on Wednesday. Consequently, the global equities risk sentiment and USD price action will remain major determinants for further gold recovery in the near term.

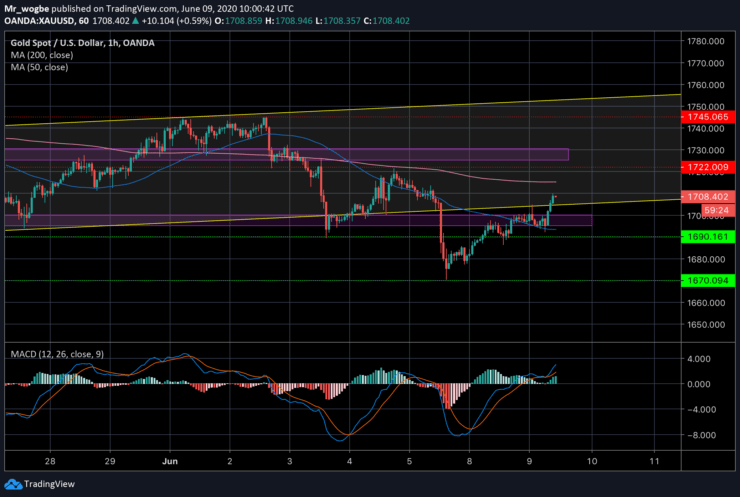

Gold (XAU) Value Forecast — June 9

XAU/USD Major Bias: Bullish

Supply Levels: $1,710, $1,717, and $1,722

Demand Levels: $1,690, $1,677, and $1,670

Gold remains in a slow but steady climb back into our ascending channel and subsequently to its previous top ($1,744). However, the path of least resistance (both technically and fundamentally) remains at the downside making a clean recovery from this point very difficult.

Meanwhile, a clean break and close above the $1,715 (200 MA) could give gold more fuel to push further to the upside.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.