The growing expectations of implementation of additional stimulus relief packages across the globe coupled with the hopes for a swift V-shaped economic recovery are taking preference away from safe-haven assets like Gold and placing it in the global equity markets.

The Japanese government is contemplating a second COVID-19 relief package while the European Central Bank is expected to declare an additional €500 billion bond-buying program in its next meeting.

Notwithstanding the sudden bearish bias, the volatile civil unrest across cities in the US and the ever-increasing worries over the pandemic-induced economic strain will serve as a major obstacle for Gold bears.

Meanwhile, the medium-term bullish bias remains for the yellow metal as long as it sustains itself above the $1,700 pivot/psychological level.

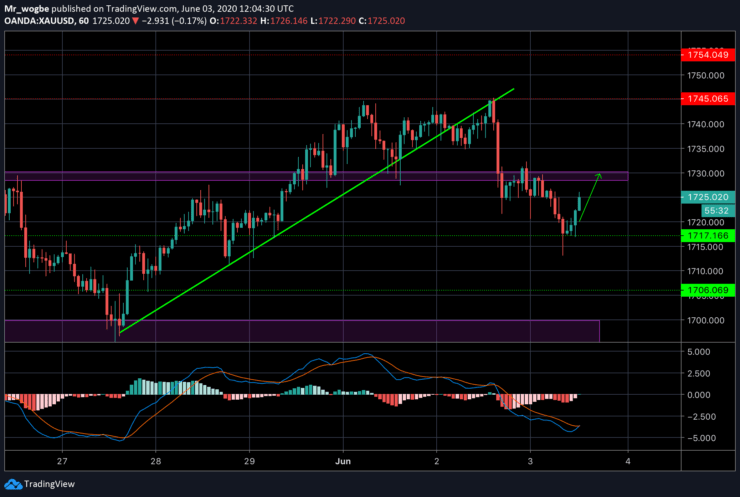

Gold (XAU) Value Forecast — June 3

XAU/USD Major Bias: Bullish

Supply Levels: $1,730, $1,745, and $1,754

Demand Levels: $1,706, $1,700, and $1,694

Gold is in a recovery from yesterday’s unprecedented dip from the $1,745 resistance. The $1,717 is expected to hold and propel price to its previous high and above. However, if bulls fail to defend this level we could see a further decline to the $1,700 pivot.

Nonetheless, as long as gold price remains above $1,700, the overall bias remains bullish.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.