With the European equity market picking up buoyancy and the budding US-China tensions causing the dollar to be in demand, gold has remained under pressure for most of today.

General Manager of ABC Bullion in Sydney, Nick Frappell, said in his weekly preview that gold might drop to the $1712-10 support levels in the short term. However, he strongly believes that if this happens, it could pave the way for a very powerful bullish breakout.

Also, Japan has announced that it is ready to remove the state of emergency restriction in five regions in the country ahead of schedule. This decision is indicative that the coronavirus pandemic is slowing down in several parts of the world, giving riskier assets more demand.

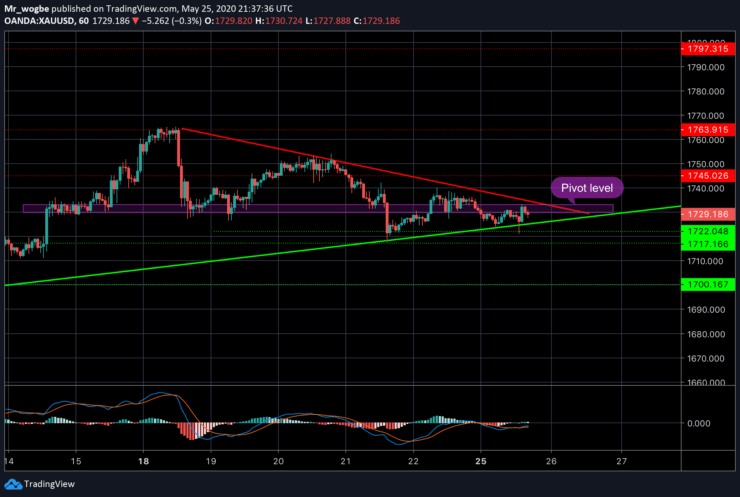

Gold (XAU) Value Forecast — May 25

XAU/USD Major Bias: Bullish

Supply Levels: $1,745, $1,763, and $1,797

Demand Levels: $1,722, $1,717, and $1,700

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.