Much like the US dollar, the yellow metal appears to not have any bearing at the moment despite escalating diplomatic tensions between the US and China. The developments over the weekend coupled with the arrest of Jimmy Lai, Under the National Security Law did little to influence the price action of gold or the markets at large. Market participants are now awaiting ‘definition’ from Washington and further developments regarding the stimulus package.

Meanwhile, some analysts at CitiBank have expressed their optimism about gold’s price trajectory in the near-term. They explained that their short-term target had been moved up to $2,100/oz and that $2,300 seemed achievable. The analysts cited the record pace of ETF investor inflows, the weakening US dollar, and negative yields as the primary factors that could favor gold to push higher.

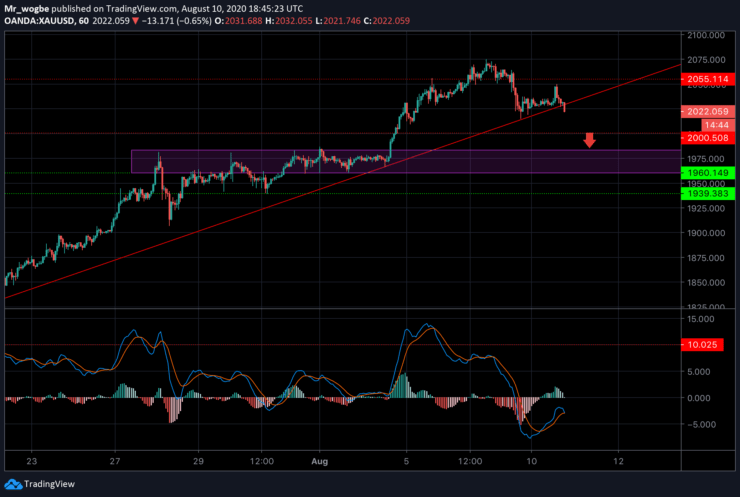

Gold (XAU) Value Forecast — August 10

XAU/USD Major Bias: Sideways

Supply Levels: $2,035, $2,050, and $2,075

Demand Levels: $2,025, $2,010, and $2,000

Gold has now failed to record a new all-time high for the first time in a week despite the primary trend leaning towards the upside. The current correction appears to be long overdue, yet no significant changes are occurring. In the near-term, we’re likely to see the $2,010 support and possibly the $2,000. A continuation from that level could send us straight to the $1,980 level before a bounce will be seen.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.