XAUUSD Price Analysis – February 26

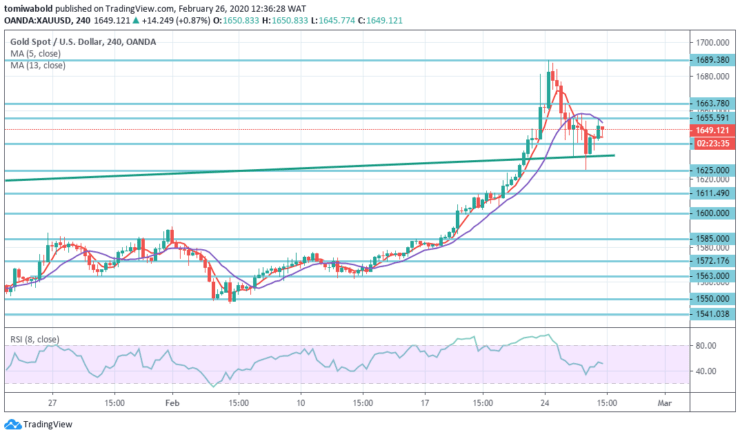

During the Asian session, gold rose to a higher level into the European Session on Wednesday and is currently at the top of its daily trading range of $1625-55 levels. Fears of the global outbreak and impact of the new virus on the global economy have compensated for a modest recovery in the global risk bias.

key Levels

Resistance Levels: $1,689, $1,663, $ 1,655

Support Levels: $1,625, $1,611, $1,585

XAUUSD Long term Trend: Bullish

XAUUSD was down more than 0.70% during the day. This happens immediately after the price has risen to a seven-year high. While trading past the level of $1,640, large bulls may stay untouched and shortly focus on immediate goals at $1,689 / $1,700, as traders stay cautious and set for new purchases in safe-havens because of fears of coronavirus pandemic.

A clear breakthrough of the $ 1,640 level, on the other hand, can give the first reversal signal and open the way for a deeper correction to the next significant support levels at $1,625/11 and the $1,600 level in case of expansion.

XAUUSD Short term Trend: Bullish

On the 4-hour timeframe, we see a continuation of the bullish movement after the rollback, while the recovery from the $1,625 level recent low is encouraging, the metal has yet to defy the channel’s falling resistance at $ 1,655.

Closing this level may mean the end of the rollback from recent highs near the level of $ 1,689 and may change the risk in favor of raising to the level of $ 1,655. A breakthrough is likely to stay unattainable if prices find recognition beneath the session low of $ 1,636 level.

Instrument: XAUUSD

Order: Buy

Entry price: $1,636

Stop: $ 1,625

Target: $1,660

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.