Growing worries over the deteriorating US-China relations drove investors to seek refuge in traditional safe-haven assets. This, consequently, caused gold to maintain its bullish momentum through Monday, making it the seventh consecutive bullish session.

Also, increasing concerns over the halt of any recovery in the US economy coupled with intense selling around the US dollar bolstered the dollar-denominated commodity even further.

Meanwhile, it appears as though the possibility of the US Fed adding additional stimulus to bolster the economy is already getting priced-in across markets. This could be observed in the prevailing decline in the US Treasury bond yields, which supported the non-yielding precious metal even further.

Moving on, market participants will be looking at the US economic docket—which features the US Durable Goods Order data release—for subsequent trading opportunities later today.

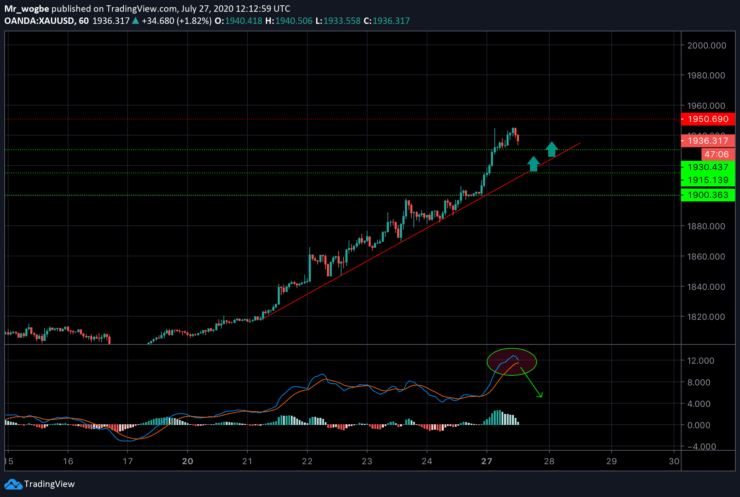

Gold (XAU) Value Forecast — July 27

XAU/USD Major Bias: Bullish

Supply Levels: $1,944, $1,950, and $1,960

Demand Levels: $1,930, $1,915, and $1,900

Gold has gotten a taste of intense bullishness and appears to not be relinquishing it anytime soon. The yellow metal picked up additional momentum over the weekend following several favorable fundamental factors. Also, the strong “follow-through” buying pressure can be attributed to the defeat of the previous all-time high level ($1,921) set in September 2011, where buyers seized the opportunity and took the commodity even higher.

We have, once again, wandered into overbought conditions, and buyers will be cautious at this level considering the growing risk-on mood.

That said, we will be waiting for a slight pullback in the near-term where gold would most likely pick up more dip-buyers before expecting further climbs.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.