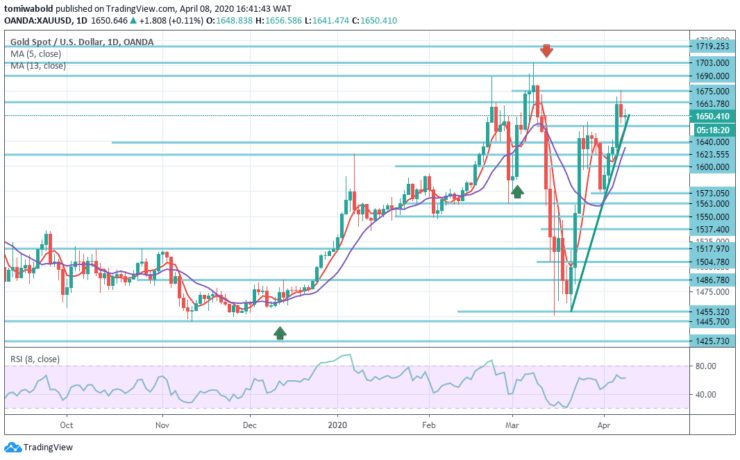

XAUUSD Price Analysis – April 8

Gold continued its consolidated volatility through the early North American session and is presently positioned around the $1,650 region in the familiar territory. Notwithstanding troubling reports about the coronavirus outbreak, the precious metal continued with momentum on the upside while staying fragile.

Key Levels

Resistance Levels: $1,703, $1,690, $1,675

Support Levels: $1,600, $1,573, $1,550

XAUUSD long term Trend: Bullish

The XAUUSD had managed to reach the level of $1,675.00 in the previous session. The commodity was trading at the level of $1,650.00 during today’s morning, considering that yellow metal is backed by the steep ascending trendline near the $1,650.00 level, some potential for growth may probably persist in the market.

The exchange rate might in this scenario break the $1,675.00 threshold. On the other hand, within the subsequent trading day, the price of gold may begin to stabilize against the US Dollar.

XAUUSD Short term Trend: Bullish

Considering the strength of the big bullish candle on Monday, while during yesterday’s session, gold registered some sort of near-term retracement, the breakout sentiment refused to budge on a market correction to the $1,640 level breakout and suggests that this near-term reversal affirms the return of bulls.

Momentum indicators are positively positioned across the market, with RSI supporting the breakout to multi-week peaks, while the moving average of 5 and 13 lines pulls beyond the rising trendline into a positive setup.

Instrument: XAUUSD

Order: Buy

Entry price: $1,640.00

Stop: $1,623.55

Target: $1,663.78

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.