XAUUSD Price Analysis – March 25

The risk-off mentality that prevailed in the markets has sparked a rebound in Gold’s price. Gold prolonged his pullback from nearly two-week tops and dropped in the last hour under the $1,600 mark briefly, but bounced back some later.

Key Levels

Resistance Levels: $1,703, $1,675, $1,663

Support Levels: $1,563, $1,550, $1,517

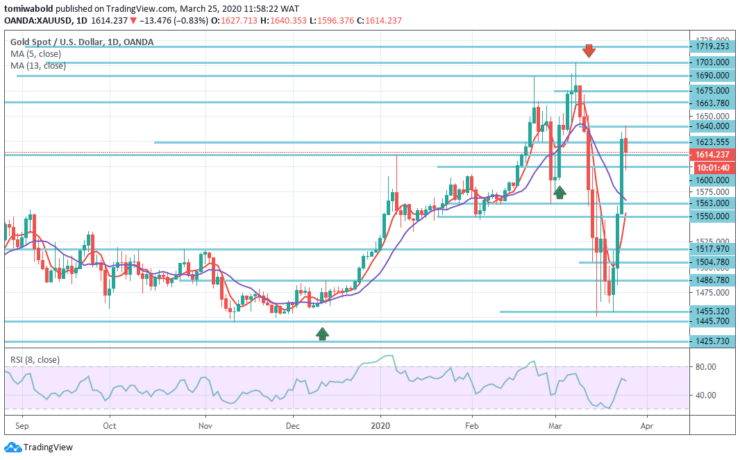

XAUUSD Long term Trend: Bullish

Gold bulls are firmly in control as projected at a very good longer-term horizontal support at $1,445/55 levels after some base building and buying over the resistance as the general bias. As long as XAUUSD stays past the level of $1,600/11, that keeps the trend optimistic as we aim for a break beyond the levels of $1,623/40 to reach the levels of $1,663/75.

Over $1,640 level we look at the levels of $1,663 & $1,675, maybe as much as $1,690 this week. Its initial support is at the level of $1,611/00 but below the level of $1,517 is less optimistic at the level of $1,563/50 & $1,517/04, however it is anticipated that the downside would be restricted.

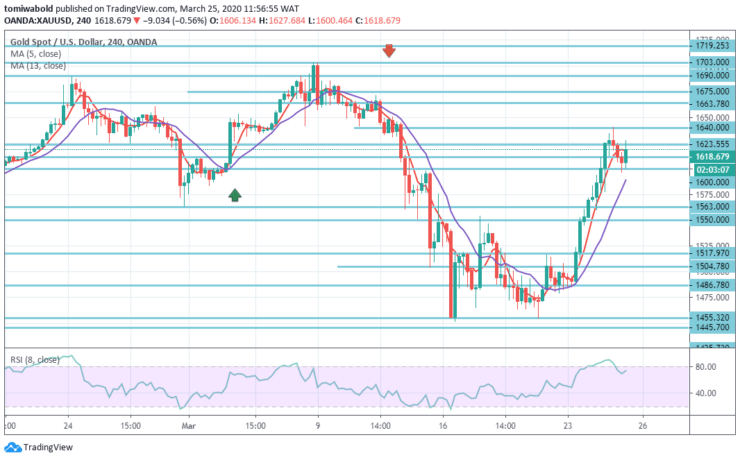

XAUUSD Short term Trend: Ranging

Gold prices have risen more than 4 percent on the 4-hour time frame as market activity pushed through various levels of resistance. The gains come after the $1,563 major level of resistance was broken very quickly.

Gold levels trade over the $1,600 mark at the time of publishing. We anticipate prices to skyrocket toward the $1,700 handle despite the current uncertainty. Conversely, the downside risk could be seen opening up by a close beneath $1,563 level.

Instrument: XAUUSD

Order: Buy

Entry price: $1,600.00

Stop: $1,563

Target: $1,640

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.