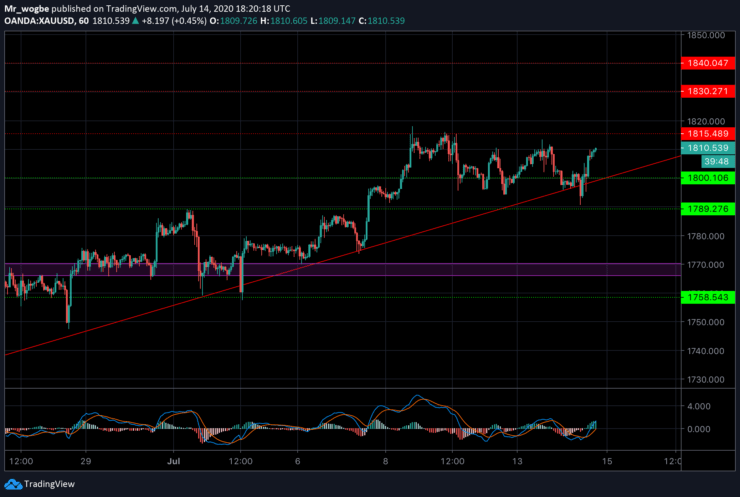

On the technical scape, this was a pullback to the prevailing ascending trendline and a bounce from this level looks very possible. That said, gold is expected to resume its original bullish trend soon.

Meanwhile, any further gains from this level will likely be met with strong resistance at the $1,815 level. A clean break above that resistance will open gold up to retest its last week’s Wednesday multi-year high ($1,818.09).

On the flip side, a sustained drop below the $1,790 level will put gold under intense sell pressure, which could send it spiraling down towards the $1,770 pivot region.

On other news, the US CPI data release failed to extend any support to the dwindling US dollar demand. Moving on, the dollar-denominated commodity could resume on its bullish momentum in tomorrow’s Asian session as the worsening global Coronavirus crisis takes center stage.

Gold (XAU) Value Forecast — July 14

XAU/USD Major Bias: Bullish

Supply Levels: $1,815, $1,818, and $1,827

Demand Levels: $1,800, $1,790, and $1,780

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.