The yellow metal has also failed to take full advantage of last week’s impressive bounce from a three-week low ($1,862) and has been in a consolidation range for a few trading sessions since then. The prevailing US dollar weakness was regarded as the major factor bolstering the dollar-denominated commodity.

The tensions surrounding the next round of fiscal stimulus measures in the US kept USD buyers in a defensive stance through the early trading hours on Monday. This coupled with the weak bias around the US Treasury bond yields extended extra support to the non-yielding metal.

However, the overall goodish risk sentiment in the global market has kept a lid on any further gains in gold. The global risk-on mood was bolstered by the hopes over a potential Coronavirus vaccine and the rescheduling of the US-China trade deal review, originally slated for Saturday.

Meanwhile, investors appear to be playing it safe with gold and are staying on the sidelines ahead of the FOMC meeting minutes release, scheduled for Wednesday. That said, volatility will likely be diminished in the near-term.

Gold (XAU) Value Forecast — August 17

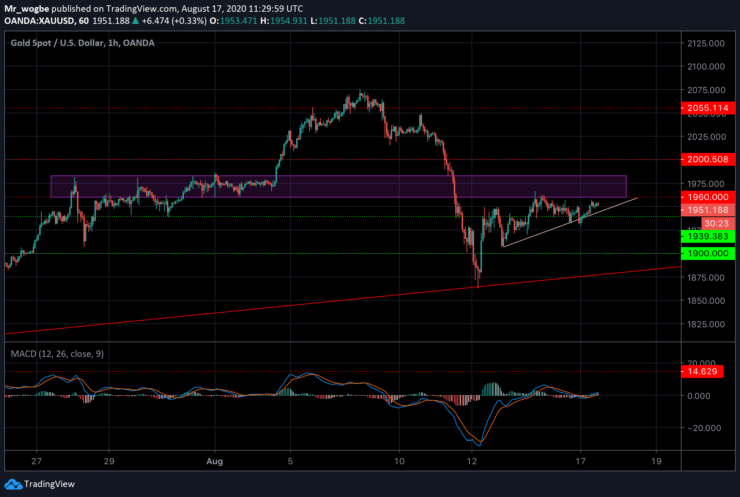

XAU/USD Major Bias: Sideways

Supply Levels: $1,960, $1,983, and $2,000

Demand Levels: $1,930, $1,916, and $1,900

Gold has resumed Monday with its consolidation from last week, trading between the $1,961 and $1,931 levels. Giving the poor condition of the dollar, gold will likely stage a recovery to the upside soon. Also, a mini trendline can be seen on the hourly chart, confirming that while we’re in a consolidation, the trend remains to the upside.

Meanwhile, our MACD indicator shows that gold is in neutral conditions, making it adequate for a bullish trend to play out.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.