The bullish sentiment around the yellow metal remains in play as a fresh US-China squabble over Hong Kong arises. A recent Bloomberg post reports that China is ready to impose sanctions on US officials in a retaliatory response to America’s sanctions on the Hong Kong leader Carrie Lam and other top officials yesterday.

However, further gains in gold remain strongly opposed by the dollar, which is still reeling from Friday’s NFP data “high.” Also, traders want to hold on to the ‘world’s reserve currency’ ahead of the upcoming US-China talks this Saturday.

The enduring dispute between the two world powers over several issues including the tech war, Hong Kong, and Taiwan, could disrupt the whole trade deal. The growing worries continue to favor the safe-haven appeal of the dollar, which appears to be keeping gold in a corrective mode.

Furthermore, traders have reduced their bullish positions in COMEX gold contracts in August following the CFTC data. Traders’ focus will now be on developments around the US-China conflict amid little economic data from the US as Wall Street prepares to open later today.

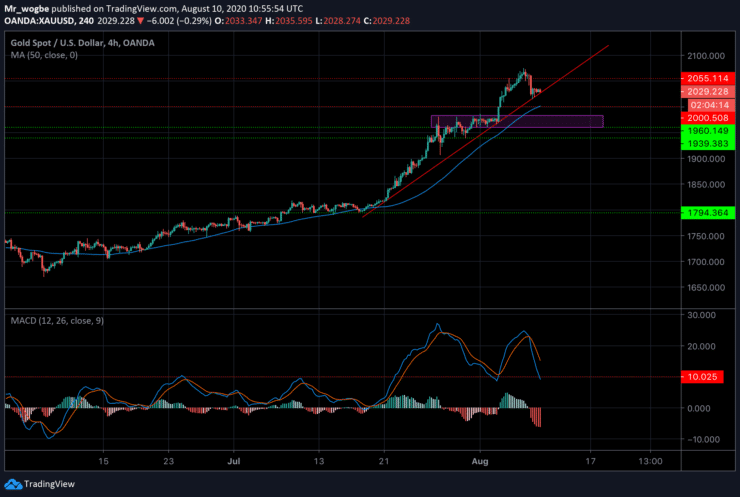

Gold (XAU) Value Forecast — August 10

XAU/USD Major Bias: Sideways

Supply Levels: $2,035, $2,050, and $2,075

Demand Levels: $2,025, $2,010, and $2,000

Gold has reacted exceptionally well to our plotted trendline after it found strong support on that level and bounced to its current position around $2,030. Meanwhile, a ‘mini consolidation’ has been formed around the $2,035 – $2,025 level.

The first obstacle to clear on the way up is the $2,035 followed by the $2,050 and subsequently the $2,075.

On the flip side, we could see the $2,000 mark again if the downwards pressure gains momentum from the $2,010 level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.