At the moment, gold bulls have now gone into “hibernation” following a strong recovery in the US dollar from a two-year low.

The greenback started picking up momentum after the executive order sanctioning Hong Kong leader Carry Liam and the outright ban of Chinese businesses like TikTok and WeChat. Additional support was granted to the USD after the US released a better-than-expected NFP data for July.

The greenback got a further boost after US President Donald Trump authorized four other executive orders over the weekend. These orders placated the stimulus deadlock by granting a $400 unemployment benefit, stopped house evictions for tenants with federal financial support, and eased the recovery of student loans.

Moving on, China’s July inflation report could have some effect on the market, however, the absence of Japanese traders could suppress that influence. Other major factors headlining the markets in the near-term are the US-America tensions and new developments surrounding the Coronavirus crisis.

Nonetheless, gold bulls are still in the driver’s seat on this as the pandemic is still well in play and the $2,000 target remains largely attainable.

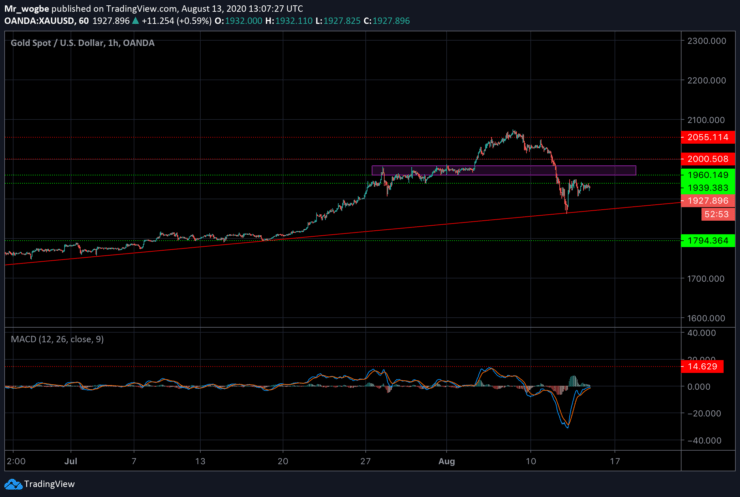

Gold (XAU) Value Forecast — August 13

XAU/USD Major Bias: Bullish

Supply Levels: $1,960, $1,983, and $2,000

Demand Levels: $1,900, $1,864, and $1,840

Gold appears to have entered a mini consolidation phase in the near-term between the $1,940 and $1,918 levels. An ascending trendline from the 15th of July remains in play as gold tries to retake the $1,940 resistance.

In the meantime, we can observe on our MACD that the yellow metal is still reeling from oversold conditions, that said, a surge to the 14.62 level on the indicator can be expected in the near-term. Which means a bull run to the $1,960-83 region could be seen soon.

On the flip side, a breach of our trendline could swiftly send gold to the $1,900 psychological line again.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.