Meanwhile, China has made progress with its clinical trials for a COVID-19 drug following positive results on animals. This has caused traders to re-evaluate their stance on their fears of a second wave of the virus mainly in the US and Asia. The Australian Finance Minister, Mathias Cormann, has warned that a second wave of the virus could cost the Australian economy about $80 billion over the next two years.

On the other hand, the US and Japan have announced that they will be keeping visa restrictions in place despite the easing of lockdown restrictions. Also, the Fed’s funds futures have renewed hopes of negative interest rates by the apex bank. That said, the US 10-year Treasury yields, S&P Futures, Japan Nikkei, and stocks in China have recovered fairly in recent trading sessions.

Meanwhile, the US Michigan Consumer Sentiment Index for May will likely be the key determinant for today’s trading bias.

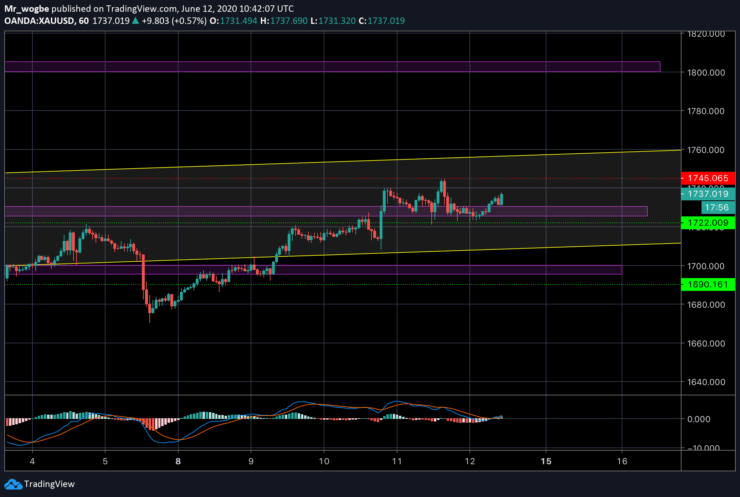

Gold (XAU) Value Forecast — June 12

XAU/USD Major Bias: Bullish

Supply Levels: $1,740, $1,753, and $1,763

Demand Levels: $1,722, $1,710, and $1,700

Gold has entered into a consolidation range between $1,722 and $1,745 as further gains are being strongly resisted by the $1,745 line. Bulls will have to break this resistance level to continue the uptrend towards higher resistance levels and ultimately the $1,800 psychological level.

Also, the possibility of gold falling below the $1,700 level is still in the picture. This bias will be completely overshadowed only when the gold defeats the $1,753 resistance and above.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.