The yellow metal has now stayed on a bullish streak for the fourth consecutive session. The US dollar remained under strong bearish pressure well into the early trading hour of Thursday and is one of the major proponents for the bullishness of the dollar-denominated commodity.

This comes on the heels of growing concerns over the ever-rising number of Coronavirus infections globally. This coupled with a slight retrace in the US equity futures provided additional support to the non-yielding metal’s safe-haven appeal. However, the prospect of a swift economic recovery remains in the picture and continues to suppress further gains in gold.

Moving on, market participants will be looking at the US economic docket, which features the release of Initial Weekly Jobless Claims, for clues. The data is expected to have some meaningful influence on the price dynamics of the USD later on today.

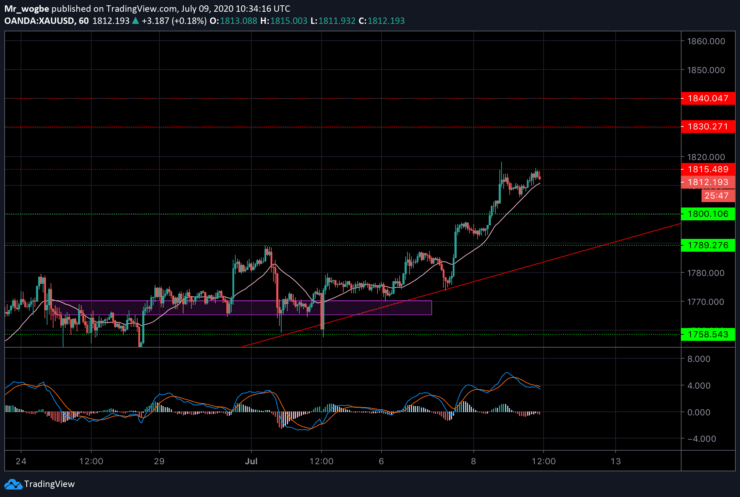

Gold (XAU) Value Forecast — July 9

XAU/USD Major Bias: Bullish

Supply Levels: $1,820, $1,830, and $1,840

Demand Levels: $1,800, $1,795, and $1,789

Gold remains in a strong bullish trend as it continues recording new multi-year tops. Currently, the yellow metal is locked in a battle with the $1,815 resistance and remains supported by the 21-day moving average line. We could see a slight pullback yet again from this level as we are still treading in overbought territories.

A fall from this level (away from the 21-day MA) will likely be immediately supported by the $1,800 and will be considered as a dip-buying opportunity.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.