The yellow metal failed to fully utilize this week’s impressive bounce from the $1,790 support level instead got caught with fresh supply on Thursday. The latest development surrounding a new Covid-19 vaccine was perceived as one of the major factors deterring demand for gold.

The precious metal was put under additional pressure after reports came in that the US President Donald Trump would hold-off from imposing further sanctions on the Chinese officials who legislated the security laws in Hong Kong. However, a White House National Security Council spokesman has assured that Trump has not ruled out further sanctions yet.

Nonetheless, concerns over the ever-brewing Sino-US tensions threw an overall risk-off tone across markets. The risk-off sentiment was bolstered by the dropping US bond yields, albeit had little effect on the non-yielding commodity.

Moving on, market participants will be looking at the US economic data dockets—which features the monthly Retail Sales, Philadelphia Fed Manufacturing Index, and Initial Weekly Unemployment Claims—for clues. The data release is expected to have a strong influence on the price action of the USD in the near-term.

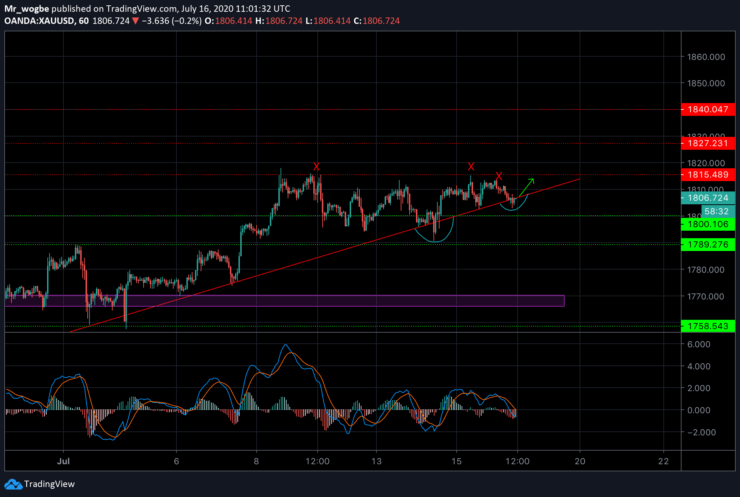

Gold (XAU) Value Forecast — July 16

XAU/USD Major Bias: Bullish

Supply Levels: $1,815, $1,818, and $1,827

Demand Levels: $1,800, $1,796, and $1,789

Gold, yet again, has failed to clear the $1,815 resistance after dropping from yesterday’s high of $1,813.49. Once again, gold is on our prevailing ascending trendline as it tries to facilitate another bounce to the upside. Buyers remain focused on the $1,815 line as the level to break.

Although a dip below the $1,796 seems unlikely, investors’ bias on gold could turn bearish if we fall below the $1,789 support.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.