Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Introduction:

The recent approval of Bitcoin ETFs marks a significant milestone in the financial landscape, ushering in a new era for cryptocurrency investors. Drawing parallels with the evolution of Gold ETFs, we delve into the transformative potential and implications of this development.

Gold ETFs: Streamlining Precious Metal Investments

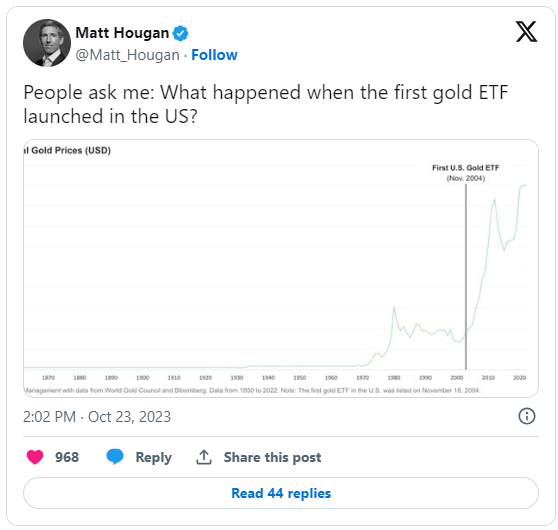

Investors have long cherished gold for its intrinsic value and stability. However, the cumbersome nature of acquiring and securing physical gold prompted the advent of Gold ETFs. Launched in Australia in 2003 and gaining substantial traction with the introduction of SPDR Gold Shares in the US in 2004, these ETFs revolutionized gold investments. The ease of buying shares in a fund, eliminating the need for physical possession, reshaped the gold market. Over two decades, the Gold ETF industry burgeoned to $270 billion by 2023, with SPDR Gold Shares leading the way.

Bitcoin ETFs: Simplifying Cryptocurrency Investment

Drawing parallels between bitcoin and gold, often dubbed “digital gold,” both assets operate outside traditional banking systems, enhancing trust. Yet, purchasing and safeguarding Bitcoin proved intricate for many. Exchanges like Coinbase and Binance marked progress but lacked integration. The introduction of Bitcoin ETFs streamlines the process. Investors can now acquire ETF shares akin to stocks, with the fund manager managing the bitcoin holdings. This integration simplifies financial reporting, enabling seamless online trading without the complexities of private keys and cold wallets.

Educational Imperative

Despite the similarities between gold and bitcoin, predicting identical adoption and price trajectories remains uncertain. Notably, gold held an advantage as its value was universally understood. A significant challenge persists in educating financial advisors and portfolio managers about Bitcoin. The recent approval, driven partly by commissions, provides a new impetus for them to comprehend and incorporate bitcoin ETFs into diversified portfolios.

The Landscape of Adoption

Financial institutions, foreseeing a surge in demand, are engaged in a “fee war,” aiming to offer the lowest fees for bitcoin ETFs. This competitive environment bodes well for investors. Projections of a substantial influx of funds into bitcoin ETFs, potentially driving BTC prices to $100,000 or even $150,000 by year-end, echo optimism. However, cautious optimism prevails, advocating a steady approach to BTC investment. Our proven steady-drip investing methodology, advocating consistent bitcoin accumulation as part of a balanced portfolio, has demonstrated commendable returns.

Gold ETFs: Conclusion

As the financial landscape evolves, the dream of widespread cryptocurrency adoption moves closer to reality. The approval of Bitcoin ETFs aligns with a broader vision of simplifying investment strategies and fostering financial inclusivity. Whether Bitcoin will mirror the trajectory of gold ETFs remains uncertain, but the stage is set for a transformative journey in the world of digital assets.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, presented product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.