XAUUSD Price Analysis – February 21

Gold resumed its advance at the beginning of the European session on Friday and jumped to new seven-year peaks, reaching $ 1,636 level. The spread of coronavirus is also of concern, as it has strongly affected investor sentiment and triggered a new wave of trade to avoid risk.

Key Levels

Resistance Levels: $1,655, $ 1,640, $1,625

Support Levels: $ 1,611, $ 1,595, $ 1,585

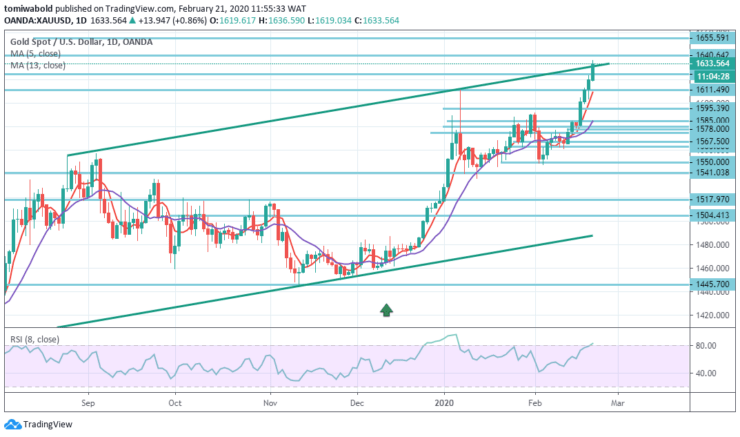

XAUUSD Long term Trend: Bullish

The yellow metal advanced to a fresh seven-year high of $ 1,636.59 level since breaking the prior peak at $ 1,625 level. The price of gold is currently holding on long bulls in the sequence from $ 1,550 level. And puts pressure on resistance turned support at $ 1,625 level, the violation of which exposes the level of technical expansion past the $ 1,636 level (fresh high).

The warning that the bulls are losing strength on the new dollar growth has outbid the daily RSI, while the bullish momentum is fading. Correctional dips beneath the $ 1,600 level are anticipated. An offer of better buying opportunities exits as its limited to $ 1,590 (close to $ 1,550 / $ 1,611). The increase in the moving average of 13 around ($ 1,585, also about 50% of the pullback) marks key support, the breakdown of which can put the bulls on hold.

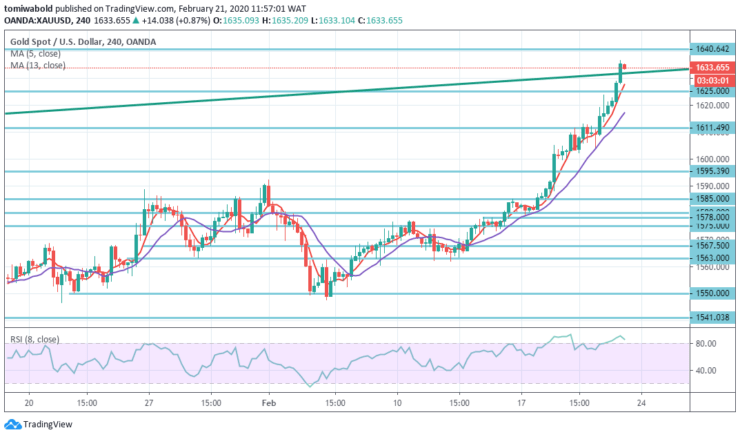

XAUUSD Short term Trend: Bullish

Earlier in the Asian session, gold rebounded by 200 points, but there is no top to the cap. In case it recovers to the levels of $1611-15, buyers can take advantage of the fall and aim at the zone of $1640-55.

On the 4-hour time frame, it may eventually register a rollback. The deepest pullback that the pair can approach is the level of $ 1,611, but if we do not see profit-taking, the price may not reach there. Therefore, most likely, traders should pay attention and buy a dip.

Instrument: XAUUSD

Order: Buy

Entry price: $1,625

Stop: $ 1,611

Target: $1,640

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.