Worries over the growing number of new Coronavirus cases and fading optimism of a sharp V-shaped global economic recovery continue to extend support for the yellow metal’s safe-haven appeal.

Gold gained further backing from the concerns of the ever-growing diplomatic tensions between the US and China, particularly after the later implemented national security laws for Hong Kong and Macau. Meanwhile, the US has retaliated by limiting exports of sensitive American technology to Hong Kong and has completely discontinued the preferential treatment regulations for China.

Despite the favorable conditions and factors, an upward rally was capped by a modest recovery in the US dollar, which in most cases undermines demand for the dollar-denominated commodity.

Moving on, market participants will be looking forward to the US economic docket, which features the release of the Chicago PMI and the Conference Board’s Consumer Confidence Index. Subsequently, the Fed Chair, Jerome Powell, will be giving testimony before the House Financial Services Committee which is expected to have a significant influence on gold in the near-term.

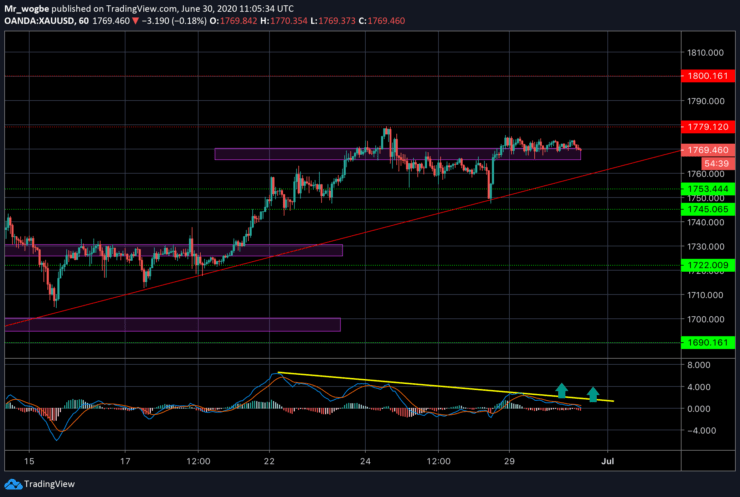

Gold (XAU) Value Forecast — June 30

XAU/USD Major Bias: Bullish

Supply Levels: $1,779, $1,790, and $1,800

Demand Levels: $1,765, $1,758, and $1,745

As proposed yesterday, we should be expecting to see a break above the trendline drawn on our MACD indicator. A break above this line will likely end the range-bound consolidation and would open the door for gold to approach the $1,800. Although a move to the downside seems very unlikely, a drop below the $1,745 support could immediately change the overall bullish bias.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.