At press time, Spot Gold is trading at $1,699 about 1.7% up from last week’s 3% drop. This drop was the sharpest one-day drop in 9 weeks and it came after the US Labor Department reported in its Non-Farm Payroll that 2.5 million Americans re-entered the labor force in May, flooring expectations for a job loss of more than 8 million.

Despite this positive outlook backing the USD, gold still holds its long-term safe-haven appeal.

The attention of investors has now turned to the US Fed’s two-day policy meeting that commences on Tuesday for clues on additional stimulus packages and the policy rate. The US government has already handed out trillions of dollars in loans, grants, and unconditional aid to businesses and individuals in recent months following the Coronavirus-induced economic crisis. However, it may be difficult for the Fed to sustain its accommodative stance if, according to the latest employment data, the economy is already recovering.

Ed Moya, an analyst at OANDA, states that gold might not receive much support from the Fed but, geopolitical risks, a second wave of the Coronavirus, and an ultimately weaker USD will likely sustain a long term bullish sentiment for gold.

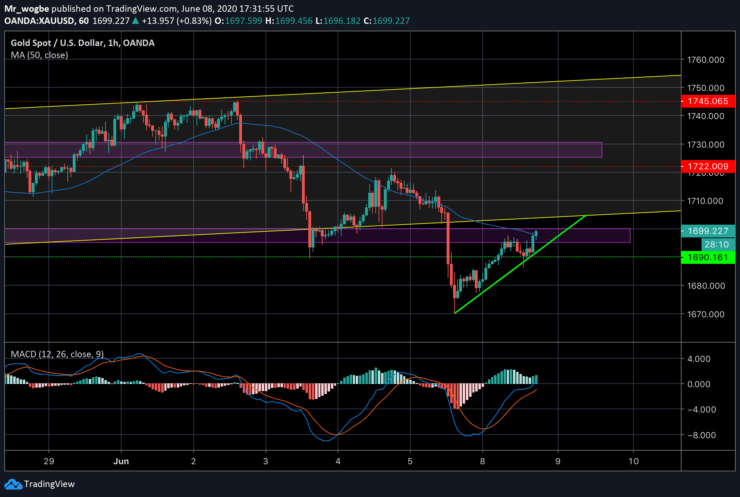

Gold (XAU) Value Forecast — June 8

XAU/USD Major Bias: Sideways

Supply Levels: $1,700, $1,710, and $1,717

Demand Levels: $1,690, $1,677, and $1,670

Gold continues in a sideways momentum for the time being but has shown great strength in recovering from the drop. A close above the $1,700 is majorly what bulls need to see before they can start buying again. Already, gold appears to be strong above the 50-day moving average and looks very likely to conquer the pivot soon.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.