Worries over the exponentially-increasing Coronavirus cases globally and deteriorating US-China relations continue to lend support to the safe-haven appeal of gold. This coupled with the recent weakness in the US dollar provided additional support for the dollar-denominated commodity.

However, excitement over a potential Covid-19 vaccine has reinstated investors’ desire for riskier assets. The risk-on resurgence was bolstered by a decent uptick in the US Treasury bond yields, which could hamper further gains in the non-yielding metal.

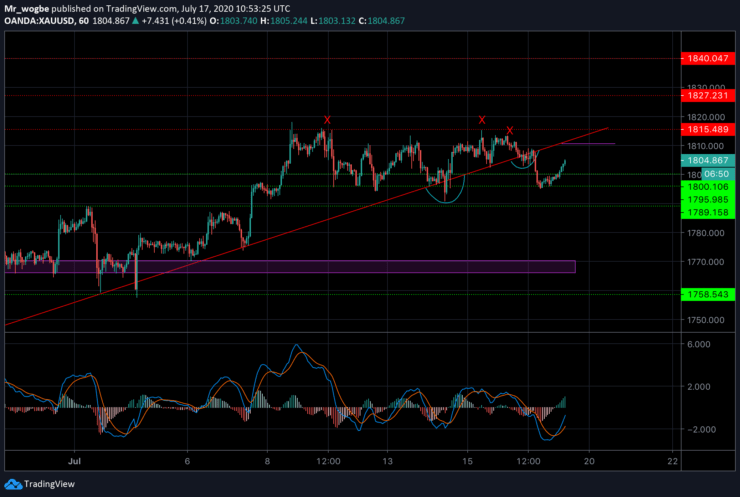

Consequently, a fresh bullish wave will likely be met by strong resistance at the $1,810 level. This means buyers will be waiting to see some gains above that resistance line in the near-term before jumping on board and taking the price higher.

Moving on, market participants will be looking at the US economic docket—which features the housing market data and Preliminary Michigan Consumer Sentiment Index—for clues today. The data release is expected to have a decent amount of influence on the price dynamics of the USD.

Gold (XAU) Value Forecast — July 17

XAU/USD Major Bias: Bullish

Supply Levels: $1,810, $1,815, and $1,818

Demand Levels: $1,800, $1,796, and $1,789

Gold has recaptured the $1,800 level after a strong retrace yesterday. As projected, the yellow metal was met with strong support at the $1,796 level and managed to pick up some buyers at that line.

Although gold appears to have stabilized above $1,800, a decline from this level is not off the table. However, the $1,796-89 support region is expected to hold.

On the flip side, a move upwards appears to be the next possible course of action, considering the overall bias is still bullish. We are likely to see a retest and break above the $1,810 supply level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.