A decent rise in the US dollar demand placed some pressure on the dollar-denominated commodity in the early trading session on Monday. However, several other factors prevented gold from dropping significantly and facilitated a dip-buying opportunity.

The risk-off factors included the waxing worries over increasing Coronavirus cases globally, which has decimated hopes for a sharp V-shaped global economic recovery.

The anti-risk sentiment was further bolstered by a bearish tone in the US Treasury bond yields which strengthened the appeal for the non-yielding commodity. Furthermore, expectations for additional stimulus measures in the Eurozone and the US have provided extra support for the yellow metal.

Regardless of all these, buyers are waiting to see gold’s price dynamic above $1,810 before becoming bullish. The major target for bulls is the 8-year high around the $1,818 level.

Since there isn’t any significant economic data released from the US today, investors will be focused on the price dynamics of the USD for clues on what gold might do next.

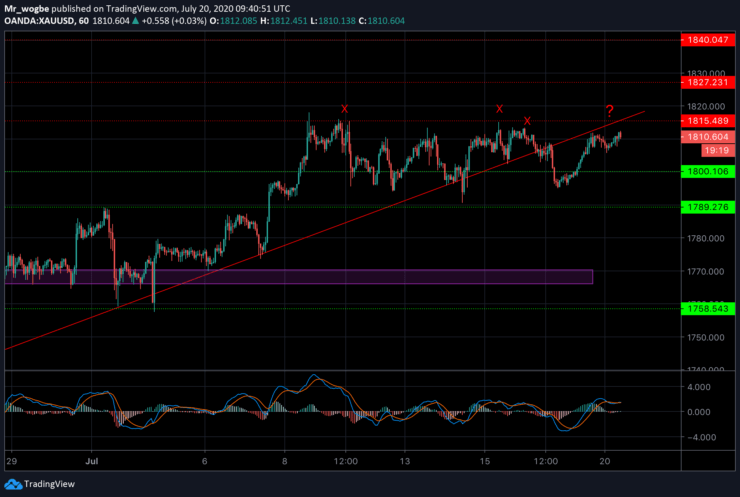

Gold (XAU) Value Forecast — July 20

XAU/USD Major Bias: Bullish

Supply Levels: $1,815, $1,818, and $1,825

Demand Levels: $1,800, $1,796, and $1,789

Gold has shown strong determination to remain above the $1,800 mark. Although gold’s price is struggling to find buyers above $1,810 at the moment, it has become obvious that the major bias will continue to be bullish above $1,800. Our previous ascending trendline has now turned into a “trip-wire” for gold and a break above that line will reinstate the original uptrend.

Given the brewing momentum, we are likely to see a $1,827/oz price tag for gold soon.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.