The yellow metal received some fresh buy bids on the first day of the week after a mild 2-day losing streak from its multi-year tops. The bullish support came from a combination of favorable conditions despite the renewing upbeat market sentiment. The record increase in Coronavirus cases globally, coupled with worries over the dwindling US-China relations lent some support to the yellow metal’s safe-haven appeal. Also, US President Donald Trump declared on Friday that there wasn’t going to be a phase-two trade deal between the world powers.

Meanwhile, the USD remained under selling pressure on the first day of the week, which created an extra boost for the dollar-denominated commodity. However, further upside gains remain somewhat uncertain at this time considering the upbeat risk tone surrounding the global equity markets.

Furthermore, investors remain confident that the worst of the pandemic is probably over even though we are on the brink of witnessing a second wave of the virus. This has caused many investors to hold-off from placing fresh bids, which has, consequently, thwarted any significant gains in gold.

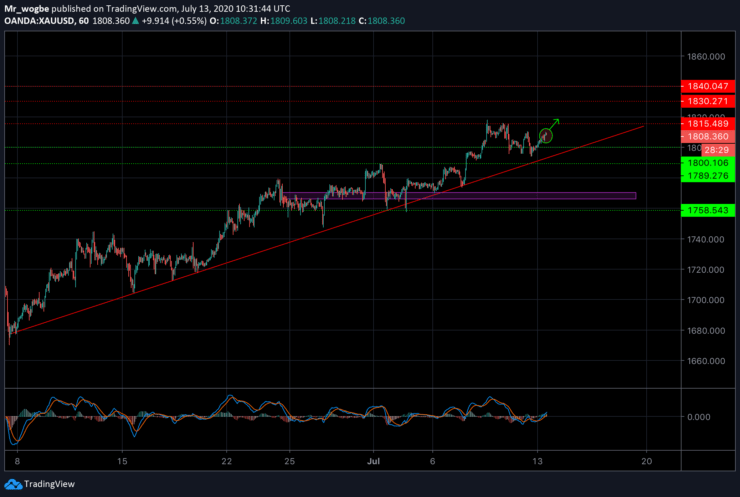

Gold (XAU) Value Forecast — July 13

XAU/USD Major Bias: Bullish

Supply Levels: $1,815, $1,825, and $1,830

Demand Levels: $1,800, $1,795, and $1,789

Gold remains in a strong bullish trend (technically) and is currently battling with the $1,810 line. Buyers will be looking for a break above that line to jump on and take the price higher. Fresh bullish steam could likely send the price above the previous highs at $1,818 as it aims for the next major hurdle at $1,825. At this point, a sustained drop below $1,800 appears very unlikely.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.