Despite President Trump’s unwillingness to place additional sanctions on China, many fear that the relations between the two economic powerhouses will continue to crumble. A Chinese publication explained that groups calling for more “fighting spirit” dominate those calling for cooperation and dialogue.

However, the US Secretary of State, Mike Pompeo, condemned the ruling Chinese party in an interview with Fox, adding that the party’s military advances should not be ignored.

Meanwhile, the protests across the United States have taken precedence for the economic outlook of this week.

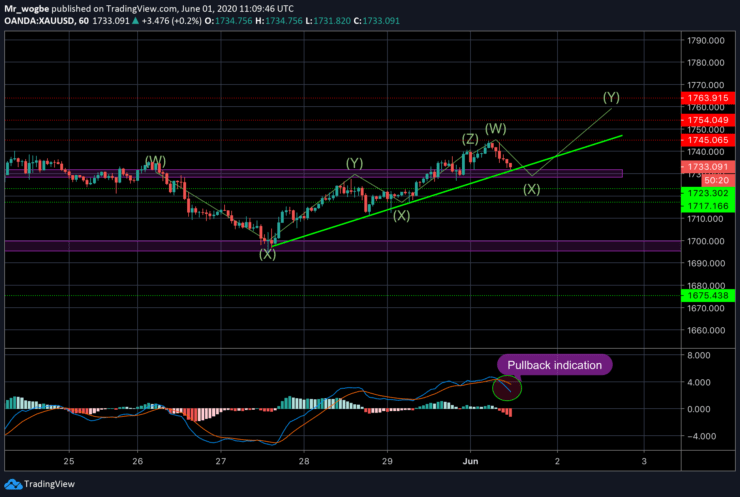

Gold (XAU) Value Forecast — June 1

XAU/USD Major Bias: Bullish

Supply Levels: $1,745, $1,754, and $1,763

Demand Levels: $1,730, $1,722, and $1,717

XAU/USD continues in line with our projection for last week. Gold is currently witnessing a slight pullback from the recent high ($1,744) to the $1,730 pivot line. This pivot line poses strong support for gold and will likely facilitate a bounce towards the $1,754 level (May 20 high) and higher. On the flip side, if gold bulls fail to defend this line, the pullback could continue to $1,722. However, gold is likely to rally for the most of this week as the US dollar might not fare well given the current state of crisis in America.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.