Gold is traded at 1,831 lower versus 1,843 Friday’s high signaling exhaustion in the short term after the last bullish momentum. The yellow metal has rallied as the USD has resumed its depreciation after poor NFP data.

XAU/USD was bullish, so the upwards movement was somehow expected. Now it has reached strong resistance, so we cannot exclude a temporary decline. USDX’s further decline could help the price of gold to resume its growth.

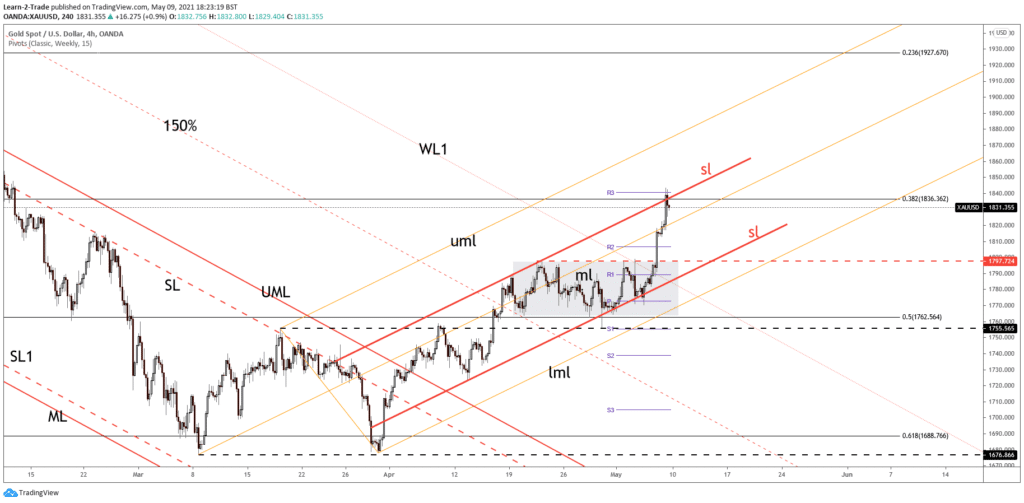

Gold increased after registering only false breakdowns below the downside inside the sliding line (sl) of the ascending pitchfork. The false breakdown with great separation below the weekly pivot 1,772 signaled an upside momentum.

The aggressive breakout through the warning line (WL1) and above 1,797 levels validated strong buyers and further growth. Now it has found resistance at the confluence area formed at the intersection between the 38.2% and the upside sliding line (sl). It was also rejected by the R3 (1,840).

It is trapped within an up channel between the inside sliding lines. A temporary decline could help us to catch a new bullish momentum, buying opportunity. The outlook is bullish, that’s why we could still search for new long opportunities

Join our VIP Telegram group HERE if you want to get the next buying signal on Gold!

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.