New research from Kaiko has revealed striking differences in how cryptocurrency markets operate across different regions, highlighting unique crypto trends that shape global adoption. The study shows that while Bitcoin leads in developed markets, emerging economies lean more towards stablecoins and alternative cryptocurrencies.

The Rise of Corporate Bitcoin Holdings in the US

US corporations have taken a strong position in Bitcoin treasury holdings, with MicroStrategy leading this movement. The company now owns over 400,000 BTC worth more than $25 billion and plans to increase its holdings to $49 billion.

Other major players like Marathon Digital have joined this trend, recently purchasing $1.1 billion in Bitcoin. This growing corporate interest signals increasing mainstream acceptance of cryptocurrency as a legitimate treasury asset.

Regional Crypto Trends and Market Dynamics

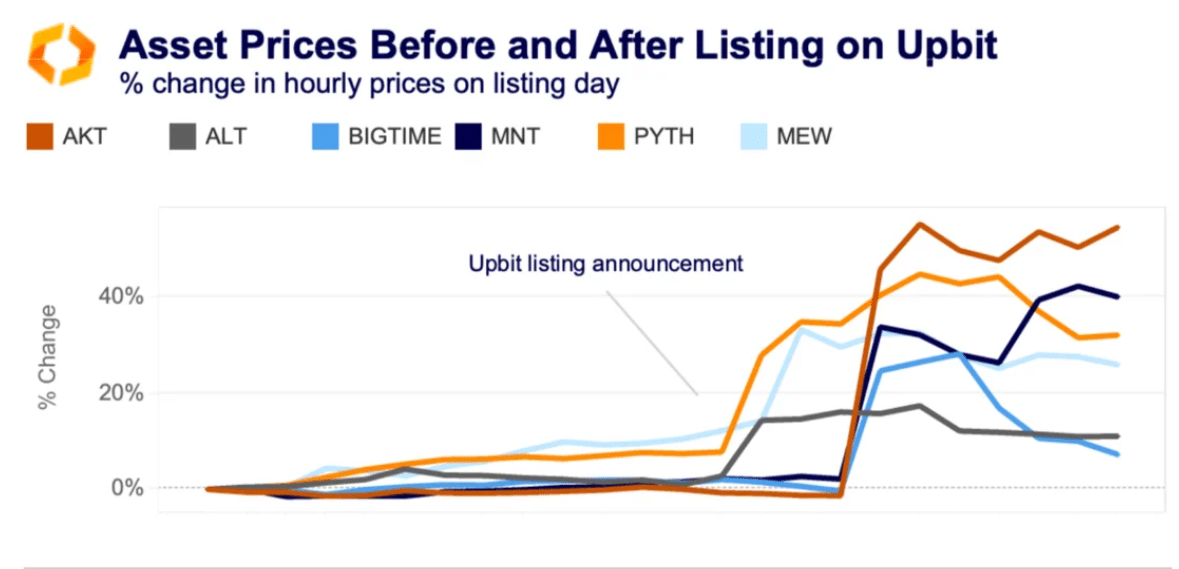

In South Korea, the cryptocurrency market shows unique characteristics, with the “Kimchi Premium” still affecting prices. The market remains somewhat isolated from global trends due to strict regulations. Korean exchanges like Upbit have significant influence, with new token listings often causing price increases of 10–40% within hours.

Japan maintains a cautious approach following the Mt. Gox collapse in 2014 but remains the third-largest Bitcoin-fiat market globally. Despite missing the 2021/22 bull run, Japanese investors show steady interest in Bitcoin exposure.

Turkey’s market presents an interesting case where stablecoins, particularly USDT, serve as a hedge against the lira’s devaluation. However, Turkish traders are increasingly diversifying into high-yield tokens, with XRP gaining significant market share.

Brazil stands out in Latin America with its progressive approach to crypto regulation. The country leads in regulated crypto products, launching the first Bitcoin and Ethereum ETFs in Latin America. Brazilian regulators have gone further by approving the world’s first spot, Solana ETF.

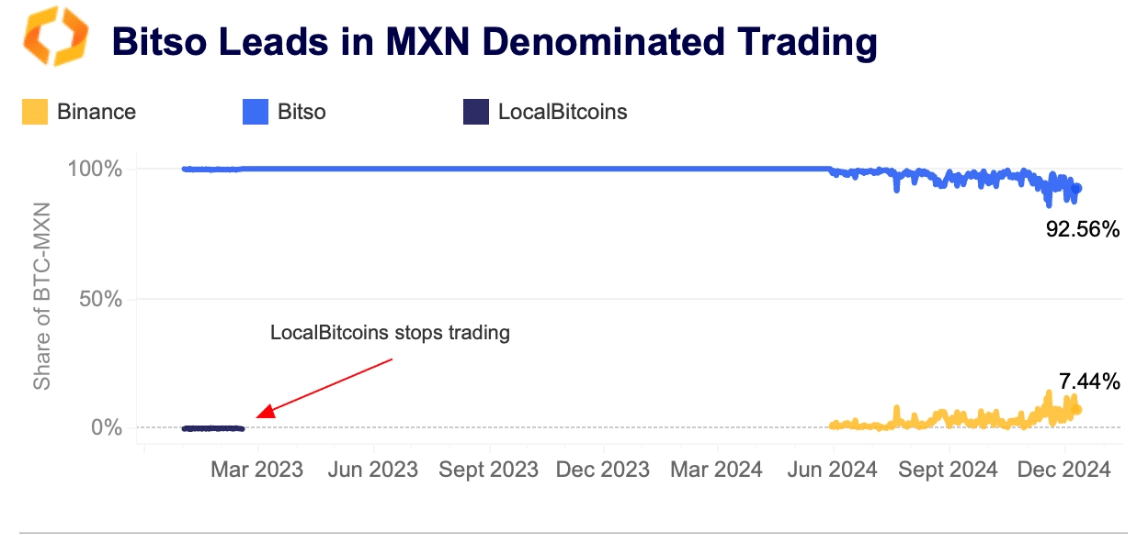

Mexico’s crypto landscape is dominated by local exchange Bitso, which controls about 93% of the BTC-MXN market despite competition from global players like Binance.

This diverse regional picture suggests that cryptocurrency adoption continues to grow but takes different forms based on local economic conditions, regulatory frameworks, and market needs. While developed markets focus on Bitcoin as an investment asset, emerging markets often use crypto as a practical tool for dealing with economic challenges.

The Kaiko research indicates that these regional differences could lead to Bitcoin’s price movements becoming less tied to traditional risk assets as adoption patterns continue to diverge across markets.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.