In a major operation that’s shaking up the cryptocurrency world, German law enforcement has taken decisive action against dozens of crypto exchanges. This move highlights the ongoing battle between regulators and platforms that operate without proper oversight.

According to a recent report from Chainalysis, on September 19, 2024, German police seized the servers of 47 crypto exchanges that didn’t follow the standard “know your customer” (KYC) rules.

These exchanges, which mainly served Russian-speaking users, allowed people to buy and sell digital currencies without providing any personal information. This lack of checks made these platforms attractive to criminals looking to hide their illegal activities.

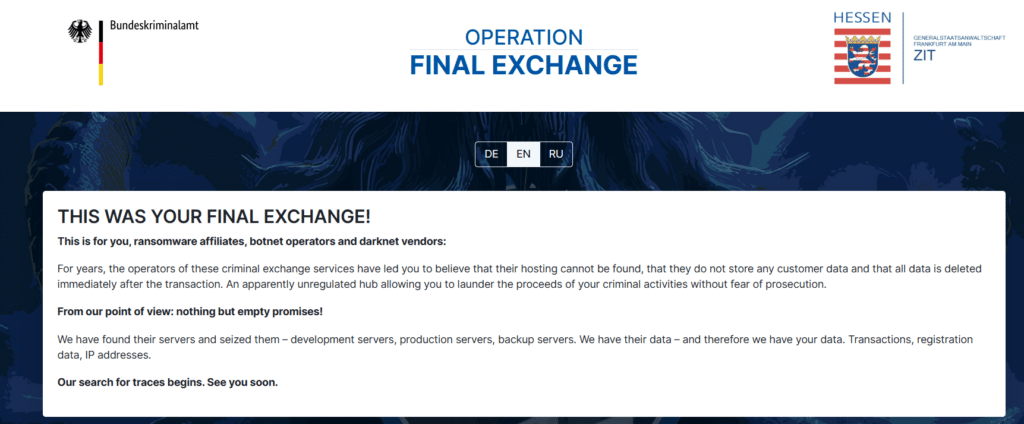

The operation, called “Final Exchange,” targeted exchanges that had been running since at least 2021, with some operating for nearly a decade. These platforms were popular among various criminal groups, including ransomware attackers, botnet operators, and dark web marketplace vendors. They also provided a way for people to get around sanctions on Russian banks.

Why Is This Crackdown on Crypto Exchanges Significant?

For starters, it shows that law enforcement is getting better at tracking and stopping crypto-related crime.

The German Federal Criminal Police (BKA) now has access to transaction details, user data, and IP addresses from these exchanges. This information could lead to more arrests and disrupt criminal networks that rely on these platforms to move money.

The takedown also sheds light on how these no-KYC exchanges work. They offer instant swaps between different cryptocurrencies and even allow users to change regular money into crypto without any checks. This speed and anonymity make them ideal for money laundering and other financial crimes.

Interestingly, some of these exchanges had started to see more transactions from legitimate sources over time. However, experts believe this might be due to Russian citizens using these platforms to avoid sanctions on their banks rather than the exchanges cleaning up their act.

The impact of this operation goes beyond just shutting down these 47 exchanges. It’s likely to cause a ripple effect in the crypto world, forcing criminals to find new ways to move their money. It also sends a clear message to other exchanges that operating without proper checks won’t be tolerated.

For regular crypto users, this news highlights the importance of using reputable exchanges that follow the rules. While the anonymity of no-KYC platforms might seem appealing, they often come with higher risks and can be shut down without warning.

Interested In Trading The Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.