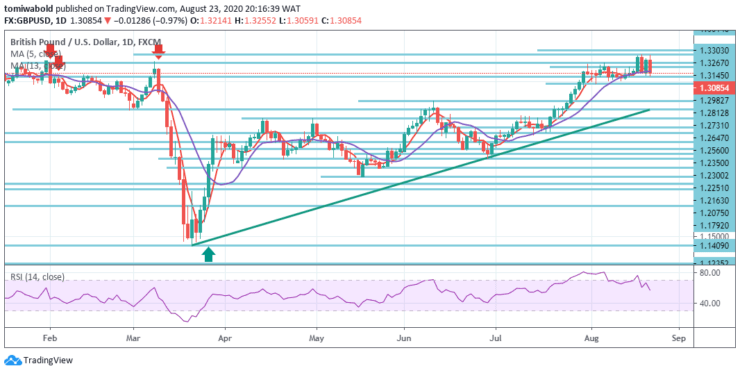

GBPUSD Technical Analysis – August 23

The GBPUSD pair ended the week unaltered in the price region of 1.3085, retreating from the year-high at 1.3267 level tested during the mid-week preceding. Nonetheless, the Brexit-related news was not so positive as yet another round of talks ended without success.

Key Levels

Resistance Levels: 1.3514, 1.3303, 1.3185

Support Levels: 1.2982, 1.2812, 1.2647

The GBPUSD pair’s daily chart illustrates it ended just around a bullish moving average 5 and 13, which tends to advance beyond the horizontal support lines. Consequently, technical indicators such as the RSI started to recede, with the momentum pushing towards its midline.

Although the rebound from the 1.1409 level is intense in the wider context, there is still not enough justification for a trend reversal. Nonetheless, a convincing breach of 1.3514 level might at least ensure bottoming in the medium term and bring out the bullish potential for 1.4376 resistance level initially.

Last week, GBPUSD crept higher to 1.3267 level but retreated swiftly. First of all, the initial bias this week is optimistic. So long as 1.3050 support level stays, a further increase is slightly in favor. The steady 100% forecast breach of 1.1409 to 1.2647 levels from 1.2075 to 1.3303 levels may open the path for next to 1.3514 structural resistance level.

Nonetheless, given the state of bearish divergence in 4 hrs RSI, a breach of 1.2982 level may validate short-term topping. The intraday bias is switched back to the downside for ascending trendline support (now at level 1.2731).

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.