Market Analysis – November 10

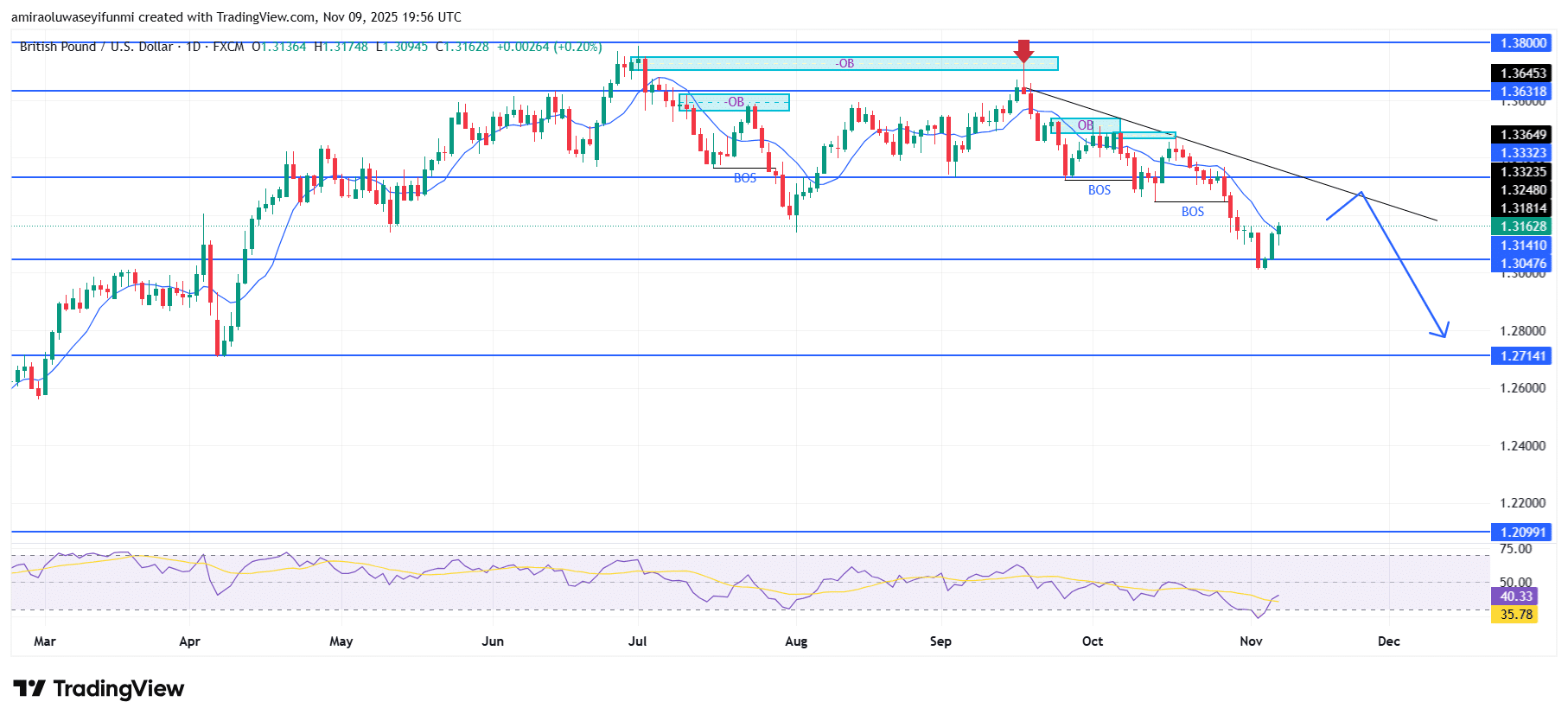

GBPUSD sustains its downtrend under persistent selling pressure. The GBPUSD pair continues to exhibit a bearish tone as sellers maintain control below key resistance areas. Moving averages confirm the prevailing downward bias, with price consistently trading below the short-term EMA. The RSI also remains beneath the 50 level, indicating weak buying momentum and limited recovery potential. Together, these technical factors reinforce a sustained bearish outlook, emphasizing sellers’ dominance over market direction.

GBPUSD Key Levels

Supply Levels: $1.3330, $1.3630, $1.3800

Demand Levels: $1.3050, $1.2710, $1.2100

GBPUSD Long-Term Trend: Bearish

From a structural perspective, multiple downside Breaks of Structure (BOS) highlight the market’s ongoing bearish progression. The pair’s recent retest of the $1.31410 support zone resulted in rejection candles, suggesting that bullish momentum is weakening. The descending trendline continues to act as a major resistance barrier, while the Order Block (OB) near $1.33320 remains a critical supply area. Unless the market achieves a decisive breakout above this zone, price action is likely to remain tilted toward further declines.

Looking forward, GBPUSD could face renewed bearish pressure if it fails to sustain above $1.32480 or breaks below the trendline. The next potential downside target lies near $1.27140, with extended bearish momentum possibly driving price closer to $1.20990. Overall sentiment remains negative, and any short-term rallies are expected to attract fresh selling interest from institutional participants, as recent forex signals continue to indicate sustained downside bias.

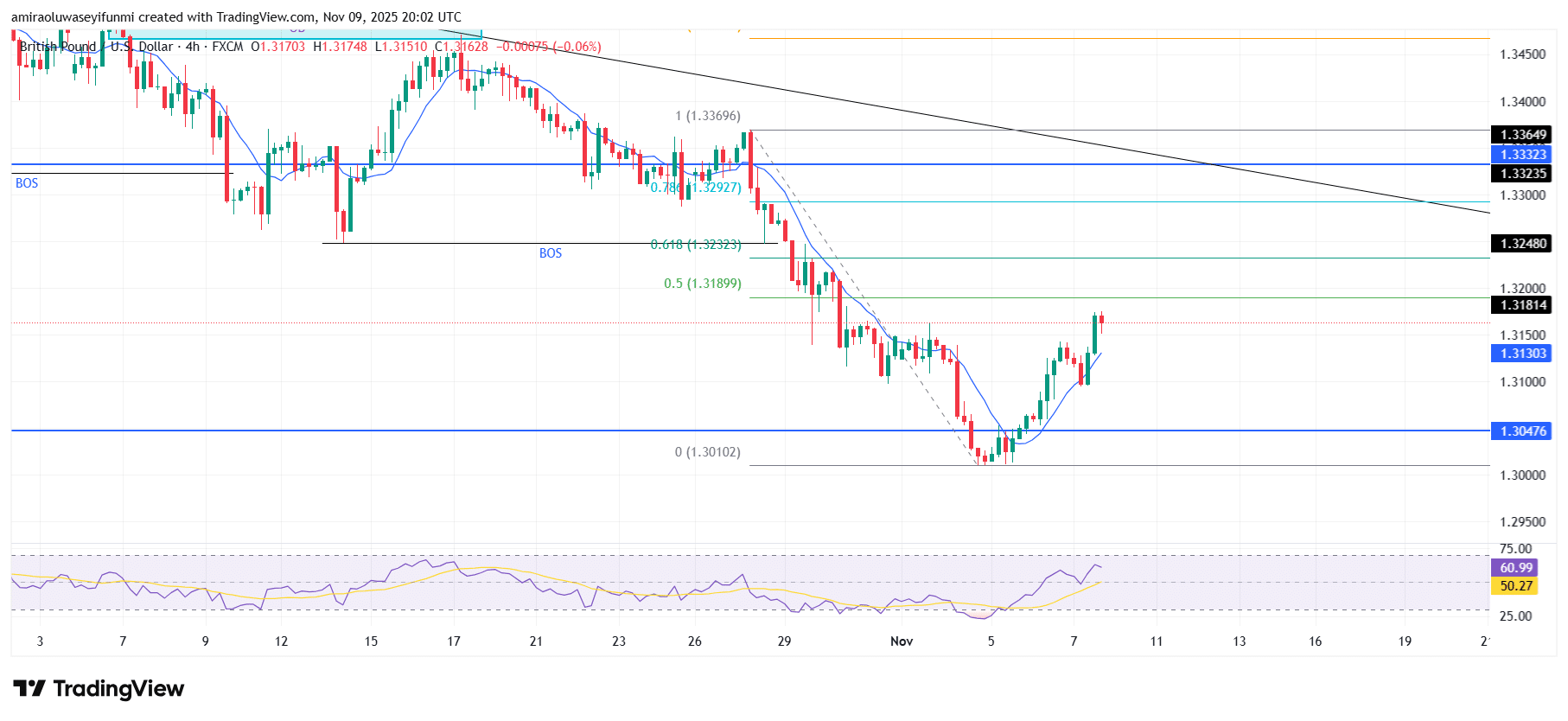

GBPUSD Short-Term Trend: Bullish

GBPUSD is displaying short-term bullish momentum on the four-hour chart as price climbs above the short-term moving average. The recent formation of a higher low around $1.30480 confirms renewed buyer participation within the ongoing corrective phase.

RSI trading above the 50 level also supports continued upward pressure in the near term. Price may attempt to retest resistance levels around $1.32480 or $1.33320 before facing renewed selling pressure.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.