Market Analysis – September 1

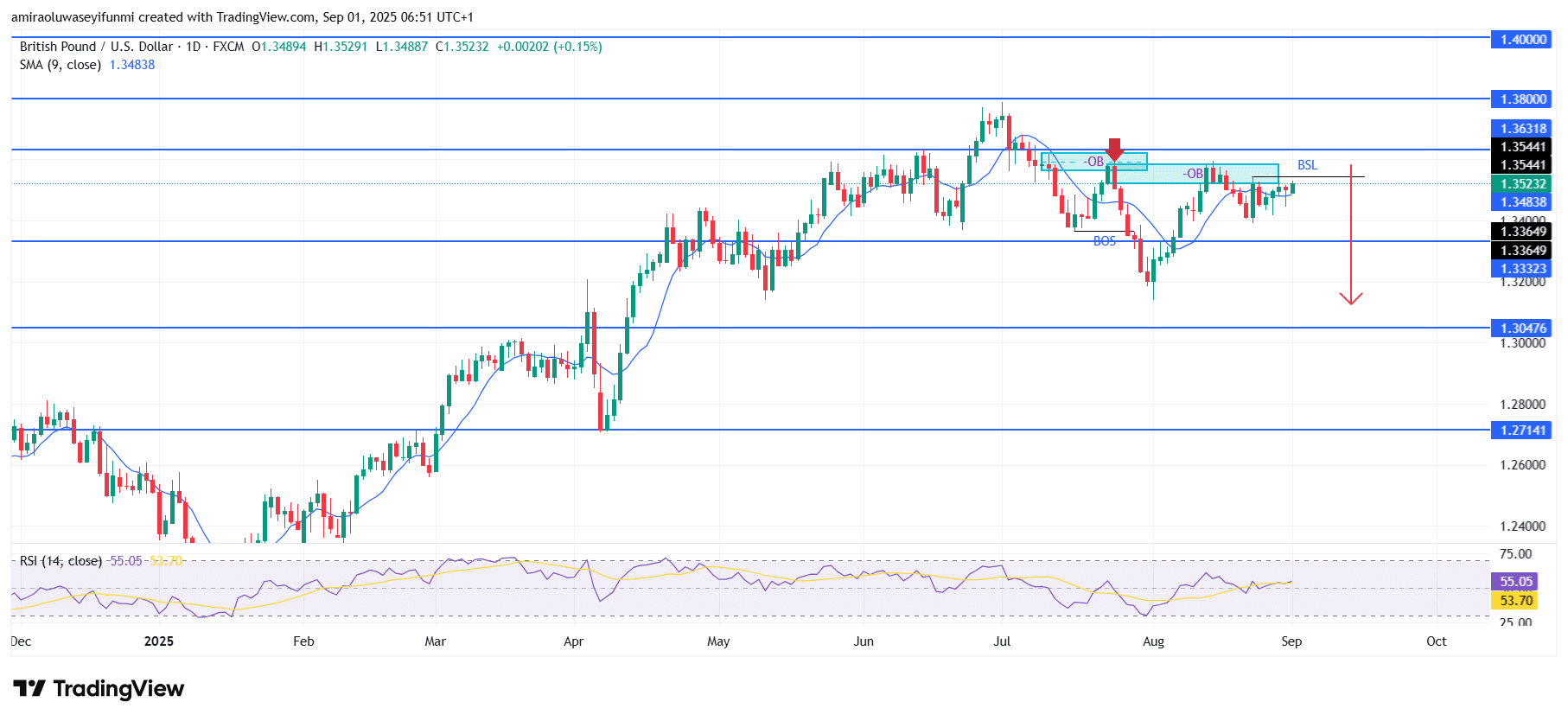

GBPUSD shows weakening momentum with potential downside continuation ahead. The pair is currently displaying signs of declining strength, with price action consolidating near $1.3520 after repeated rejections around the $1.3540–$1.3630 resistance zone.

The 9-day Simple Moving Average, now positioned at $1.3480, is struggling to sustain bullish traction, while the Relative Strength Index at 55 indicates limited upside potential. Together, these factors highlight an emerging bearish bias as the market hesitates to establish new highs despite multiple recovery attempts.

GBPUSD Key Levels

Supply Levels: $1.3630, $1.3800, $1.4000

Demand Levels: $1.3330, $1.3050, $1.2710

GBPUSD Long-Term Trend: Bearish

Based on the current market structure, the pair has developed a bearish order block around $1.3540–$1.3630, where prior supply pressures remain active. The break of structure (BOS) reinforces sellers’ dominance, while recent price action retesting this zone points toward distribution.

Looking forward, GBPUSD is likely to encounter a corrective pullback toward key support zones. Immediate support lies around $1.3370, with a deeper decline potentially extending to $1.3330. If bearish sentiment strengthens, the price could push further toward $1.3040 in the medium term. Unless buyers reclaim the $1.3630 resistance barrier, the broader outlook will remain tilted to the downside, a move also highlighted by forex signals.

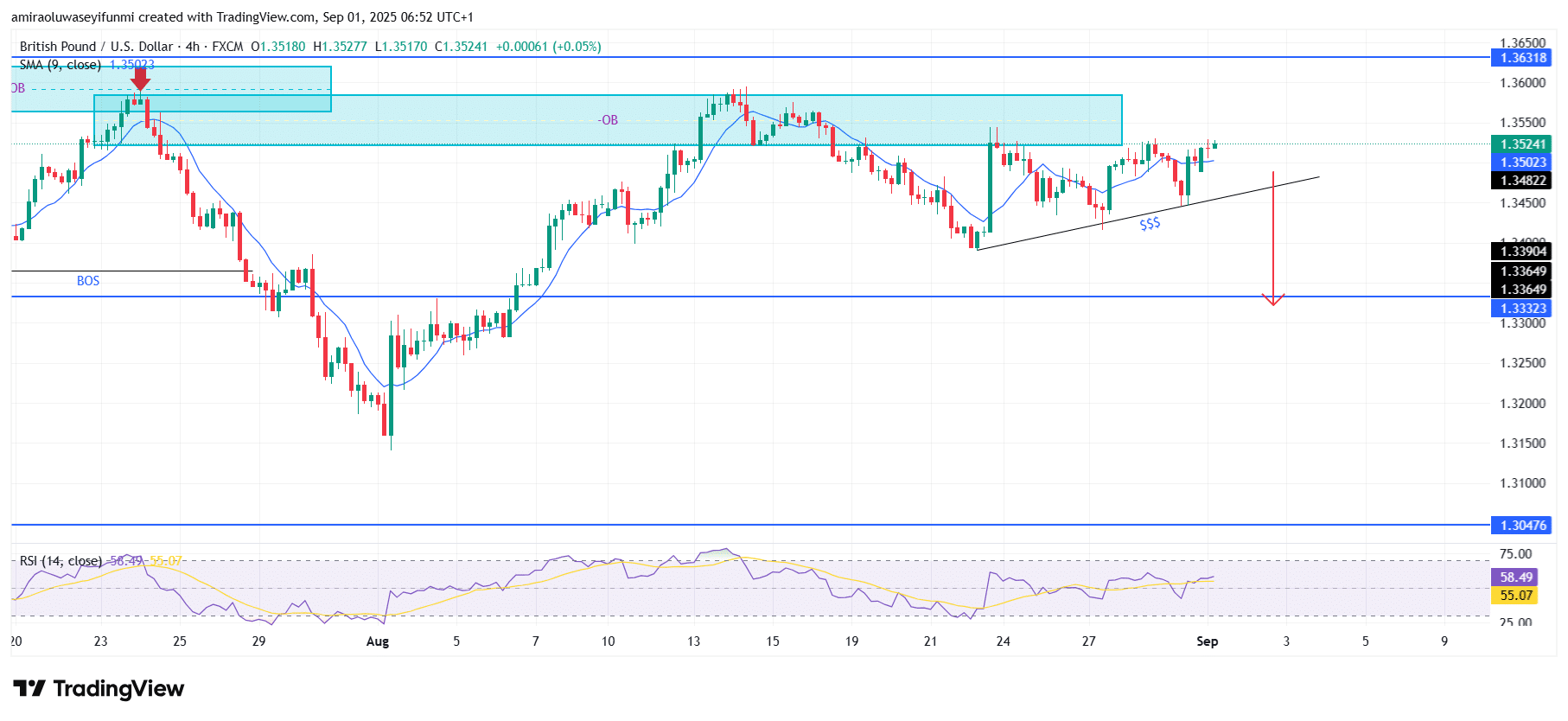

GBPUSD Short-Term Trend: Bearish

On the four-hour chart, GBPUSD continues to struggle below the order block at $1.3540–$1.3630, reflecting rejection from supply. Price is currently hovering near $1.3520 but remains capped under the 9-period SMA at $1.3500, signaling fading bullish momentum.

The ascending structure reveals liquidity build-up that is likely to be cleared, in line with the prevailing bearish bias. A breakdown could expose $1.3390 and $1.3330 as the next downside targets.

Would you like me to now refine all the articles (USOil, Gold, NAS100, GBPUSD) into a single, uniform editorial style so they read like a cohesive daily market report?

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.