GBPUSD Price Analysis – October 11

After surging 109 pips on low volume, the GBPUSD pair surged to a 4-week high of 1.3049 level, finishing the week 0.85% higher at 1.3046 level. The Sterling is running on the weakness of the dollar, and while no progress has been made in Brexit negotiations.

Key Levels

Resistance Levels: 1.3514, 1.3356, 1.3190

Support Levels: 1.2813, 1.2675, 1.2252

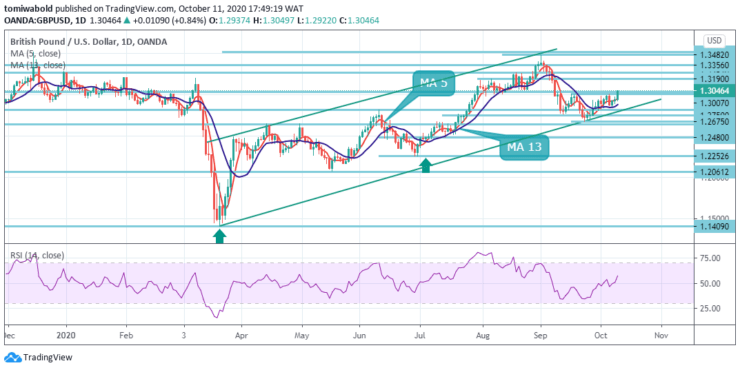

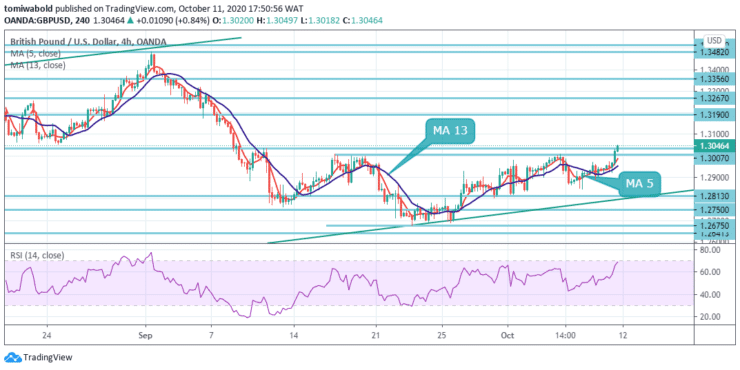

The GBPUSD pair has room to stretch its progress from a technical point of view. The daily chart implies that technical indicators maintain their bullish slopes within positive levels, while the pair settled above moving average 5 and 13. Emphasis is now back on the 1.3482 key resistance level in the wider sense.

Sustained trading beyond the horizontal resistance level (now at 1.3356) might also be a key breakout there. That at the level of 1.1409 may validate medium to long-term bottoming. Outlook for 1.4376 resistance level and above would be turned bullish. Even so, at a later phase, rejection at 1.3514 level may retain medium to long-term bearishness for another low under 1.1409 level.

GBPUSD’s violation of the resistance level of 1.3007 last week implies that the 1.3482 level correction has been achieved at the level of 1.2675. That came after the 38.2 percent retracement of 1.1409 to 1.3482 at 1.2690 levels was supported. This week, the initial bias is now back on the upside for the next 1.3482/3514 resistance zone re-test.

There might be a decisive breach with greater bullish effects and a 61.8 percent forecast target of 1.1409 to 1.3482 from 1.2675 at the next 1.3956 levels. On the downside, the 1.2813 support level breach may diminish this perspective and instead shift the emphasis back to the support level of 1.2675.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.