GBPUSD Price Analysis – February 7

The GBPUSD pair has been holding onto its uptrend despite some range trading. The pairs bulls stay unrelenting to the 1.3800 high zones as the Bank of England downplays negative interest rates boosting the pound against the soaring US dollar.

Key Levels

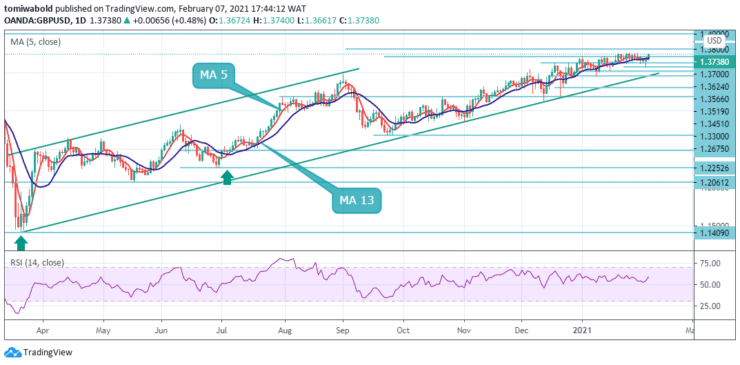

Resistance Levels: 1.4345, 1.4000, 1.3800

Support Levels: 1.3624, 1.3519, 1.3451

The daily chart implies that the pair has consolidated beyond its 5 and 13 moving averages, which lack directional strength, while the relative strength index is consolidating just beyond its midlines. GBPUSD has broken past the round figure at 1.3700 and has now reached highs around 1.3740 level as the US dollar dwindles.

A decisive breakout may occur on sustained trading outside of the upside channel resistance, which is now at 1.3800. The pattern may validate a mid-term bottom at 1.2675 low. Nonetheless, a deviation at 1.3566 prior week low will preserve medium-term bearish sentiment for another decline beneath 1.3519 level at a later phase.

The GBPUSD pair rose from the 1.3655 prior weeks low and broke the 1.3700 level. But since a temporary high has formed after the resistance at 1.3700, the initial bias is bullish initially this week. On the other hand, a break below 1.3624 may aim for a reversal trend from 1.3738 to 1.3566 from 1.2675 to 1.3700 levels.

In such a scenario, short-term sentiment may stay ranging as long as the support level at 1.3519 remains intact, in a steeper pullback scenario. Meanwhile, some subsequent sell-offs could leave the GBPUSD vulnerable to further slide beneath 1.3500 towards the 1.3451 congestion zone.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.