GBPUSD Price Analysis – January 17

The GBPUSD is trading under the 1.3500 marks after the pair lost upside traction in the prior session. The pervading sentiment suggests there is still some downside move before the pair advances again. UK PM Boris Johnson announced new travel restrictions starting on Monday.

Key Levels

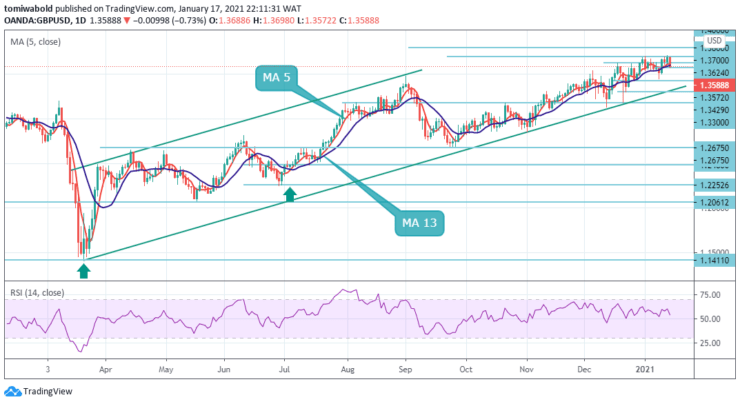

Resistance Levels: 1.3800, 1.3700, 1.3624

Support Levels: 1.3572, 1.3429, 1.3300

Earlier in the prior session, the GBPUSD traded up at 1.3698 level which was the highest level in two years. The move below that level turned the buyers to sellers which were slowed by the 1.3572 support level. The RSI is heading south in the positive area, while the price remains in the bullish territory.

If the positive traction fails to hold and prices turn lower, the next horizontal level at 1.3429 level is the nearest support that could halt steeper declines. If breached, it could shift the focus to the downside and prices could slip towards the ascending trendline support around the 1.3300 level.

GBPUSD dropped to 1.3576 last week and closed higher. Initial bias remains neutral this week. On the other hand, a break of 1.3572 should turn intraday bias downward to retest the 1.3177 low as well as the retracement from 1.1409 to 1.3429 at 1.2750 levels.

On the other hand, however, a break of 1.3624 will resume the rebound from 1.3177 to retest the 1.3700 high. In the 4 hours chart, the risk is shifting to the downside as the pair meets sellers under the ranging 5 and 13 moving average, which continues to fall below the 1.3700 level.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.