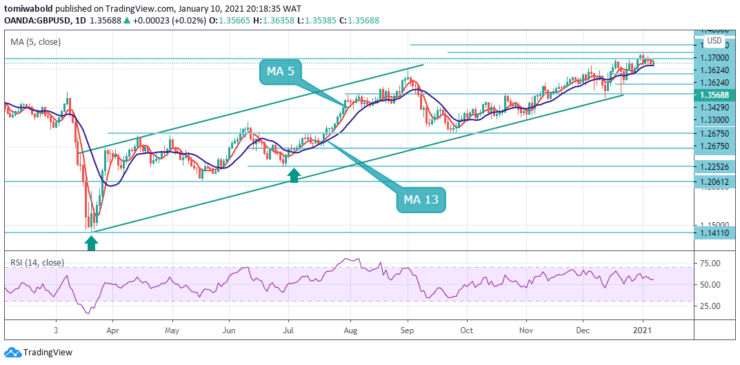

GBPUSD Price Analysis – January 10

GBPUSD continues to grapple with upside momentum in a bid to recover the 1.3600 level while the pair underperformed in the prior week as England returned to a March 2020 style lockdown. The UK entered a harsh lockdown to prevent hospitals from collapsing due to the new virus strain.

Key Levels

Resistance Levels: 1.3750, 1.3700, 1.3624

Support Levels: 1.3482, 1.3400, 1.3313

GBPUSD hit fresh highs of 1.3703 in the previous week, maintaining a moderate bullish position on the daily chart. The pair is ranging between its daily moving average of 5 and 13 while restricting the price movement with a narrow path.

Thus, from a technical point of view, the GBPUSD bullish sentiment is maintained as the forecast will be upwards for the resistance level of 1.3800 and above. Nonetheless, a deviation from the 1.3514 will maintain a medium and long-term bearish tone for another decline below 1.1409 in a later cycle.

The GBPUSD pair plunged from the 1.3700 level last week and reached the 1.3532 low level. But since a high has formed, the initial bias is neutral initially this week. On the other hand, a breakout of 1.3624 may aim for a 61.8% trend from 1.1409 to 1.3482 from 1.2675 to 1.3956 next.

In such a scenario, short-term sentiment may stay bullish as long as support level 1.3177 remains intact, in a steeper pullback scenario. Meanwhile, some subsequent sell-offs could leave the GBPUSD vulnerable to further slide beneath 1.3500 towards the 1.3400 congestion zone.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.