GBPUSD Price Analysis – December 13

GBPUSD continued weakness under the 1.3260 level may see the pair being sold towards the 1.3000 level. A nerve-wracking weekend concludes with growing fears Brexit talks could collapse. The Brexit saga lives on, promising a high dose of action.

Key Levels

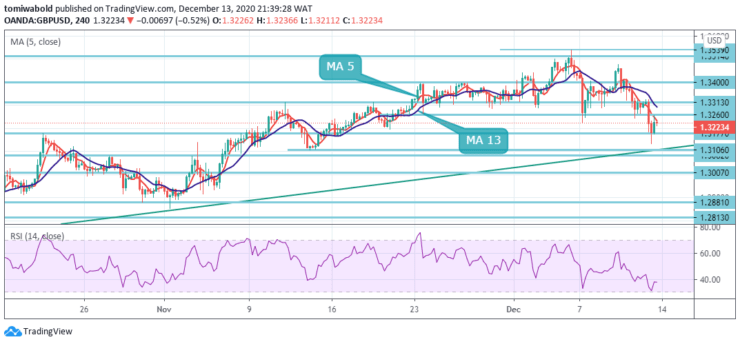

Resistance Levels: 1.3700,1.3514, 1.3313

Support Levels: 1.3200, 1.3000, 1.2813

As seen in the daily chart, GBPUSD retraced beyond 1.3200 low after hitting a fresh 1-month low of 1.3134. The pair bounced before the low and consolidated in the 1.3223 price zone. GBPUSD is poised to continue its decline as it broke below its 5 and 13 moving averages and approached the ascending trend line that provides support at 1.3106.

In a broader context, attention remains at the key resistance level of 1.3514. Continued trading above 1.3313 could also be a decisive breakout. This may validate the medium to long term bottom at 1.1409. The trend may change to bullish towards the resistance level of 1.3700 and above. Nonetheless, a deviation at 1.3514 could keep medium-term bearish sentiment for another dip below 1.1409.

GBPUSD fell to 1.3134 in the previous session as the decline continues from 1.3539. Further falls are considered this week until minor resistance level 1.3313 is broken. The RSI has crossed their midlines into oversold territory, maintaining its bearish slopes.

A persistent violation of the moving average 13 by the moving average 5 at 1.3225 should confirm another deviation from the key resistance zone of 1.3514. A steeper drop can be seen back to the 1.2675 support level. On the other hand, minor resistance below 1.3313 may change the intraday bias first.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.