GBPUSD Price Analysis – July 12

In the preceding session, the GBPUSD pair reached 1.2664 level, unable to exceed its weekly high and pull back to stay at 1.2612 level. The run was the direct consequence of the vulnerability of the wider dollar, as headlines from the UK did not offer the Pound any protection.

Key Levels

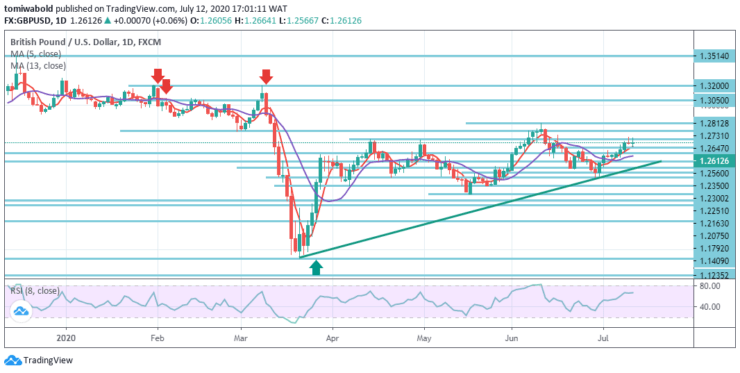

Resistance Levels: 1.3514, 1.3050, 1.2812

Support Levels: 1.2500, 1.2251, 1.1409

The GBPUSD pair is near-monthly high level of 1.2669 set on Thursday, a neutral-to-bullish trend on the daily chart. The pair have stayed beyond the moving average of 13 for a 4th successive day, with sellers positioned at 1.2647 ahead of the horizontal resistance level.

Meanwhile, technical indicators retain positives but lack strategic momentum. Although the recovery from the 1.1409 level is high in the wider context, there isn’t enough confirmation for a trend reversal. Nonetheless, a definitive breach of 1.3514 level may at least indicate bottoming over the medium to long term.

A bullish looking moving average 5 offers dynamic support in the 4-hour chart, now at a level of 1.2605, and keeps going north beyond the level of horizontal support at 1.2560. Besides that, technical indicators remain unfocused deep into positive territory, reducing the chances of a near-term downward expansion.

Yet more growth is projected as long as there is a level of 1.2500 minor support. On the positive side, a 1.2669-level breach may aim for a 1.2812-level test. Nonetheless, on the negative, breach of 1.2500 level may instead transform bias back to the downside for support level 1.2251.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.