GBPUSD Price Analysis – July 5

The GBPUSD pair held steady in the prior session beneath the 1.2500 thresholds but ended the week with solid increases. At the end of the week, optimism mingled with concerns as Britons welcomed Saturday’s reopening of social events.

Key Levels

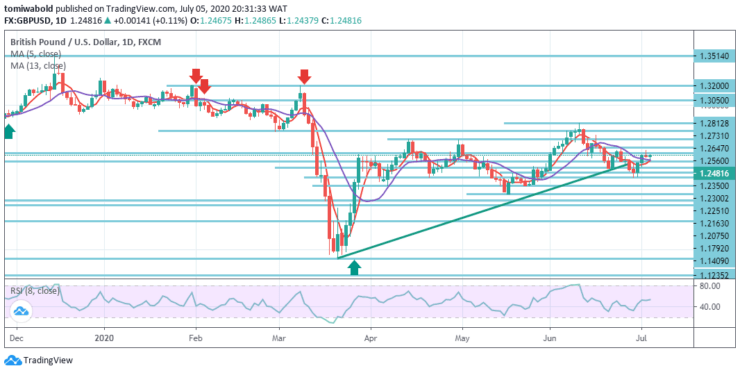

Resistance Levels: 1.3514, 1.2812, 1.2560

Support Levels: 1.2300, 1.2075, 1.1409

According to the daily chart, the GBPUSD pair heads into the weekly opening trading around 1.2482 level, with the bullish potential minimal. In the wider context, while the 1.1409 level rebound is good, there is minimal proof for a trend reversal

The price is floating around a slightly bearish moving average of 13 and beyond a firmly bearish moving average of 5 while chart patterns have lost their ascending force and have gone down marginally round its midlines.

Last week, GBPUSD declined slightly to 1.2251 level but has since rebounded steadily. Also, as observed on the 4-hour time frame, the upside was restricted to beneath 1.2560 near-term resistance. First this week the initial bias stays neutral.

In the positive, a breach of 1.2560 level may suggest that there has been a total decrease from 1.2812 level. For high level 1.2812, the intraday bias may be shifted back to the upside. In the meantime, a breach of 1.2251 level will instead continue sliding to 1.2075 near-term support level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.