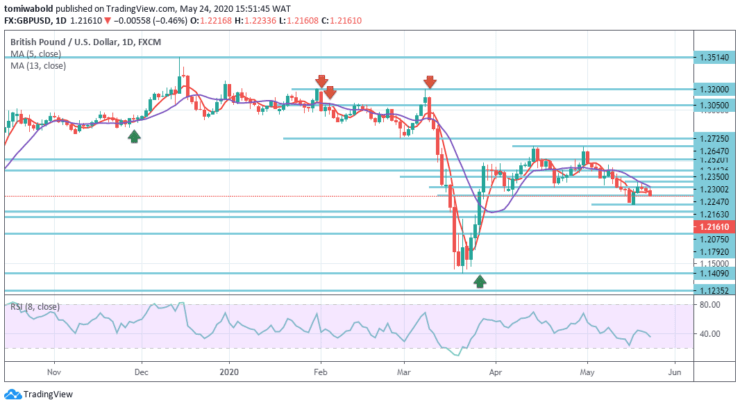

GBPUSD Price Analysis – May 24

From the last trading session, the GBPUSD pair has dropped in a row for the 3rd day, ending at around 1.2161 level. The BOE also weighed the UK currency speaking about negative rates, and Brexit-related uncertainties, as the Kingdom refuses to prolong the transitional phase past December this year, amid minimal success in negotiations with the EU.

Key levels

Resistance Levels: 1.3514, 1.2647, 1.2412

Support Levels: 1.2075, 1.1792, 1.1409

GBPUSD Long term Trend: Ranging

Last week, GBPUSD dropped sharply to 1.2075 level but has now rebounded. First this week the initial bias remains neutral, and some more consolidated trading may be seen. But as long as 1.2647 resistance level persists, the trend remains bearish.

It should have finished the rebound from level 1.1409. On the contrary, a breach of level 1.2075 may clear the path for low level 1.1409 retest. On the positive side, however, a breach of 1.2412 level may shift bias to the upside for resistance level of 1.2647.

GBPUSD Short term Trend: Bearish

The technical view is quite similar in the shorter-term, and as per the 4-hour chart, even as the pair evolves underneath bearish moving average 5 and 13, as technical indicators stay far into the negative ground, with inconsistent bearish strength but still no indications of downward burnout.

In the aforementioned timeframe, the technical indicators stay inside negative ranges, while the RSI supports further declines by moving firmly down at around 25. The next short-term goal would be a forecast of 61.8 percent from 1.7190 to 1.1958 at 1.1409 levels from 1.3514 level. In whichever scenario, in case of a strong turnaround, the trend may stay bearish as long as 1.3514 resistance level holds.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.