Market Analysis – June 9

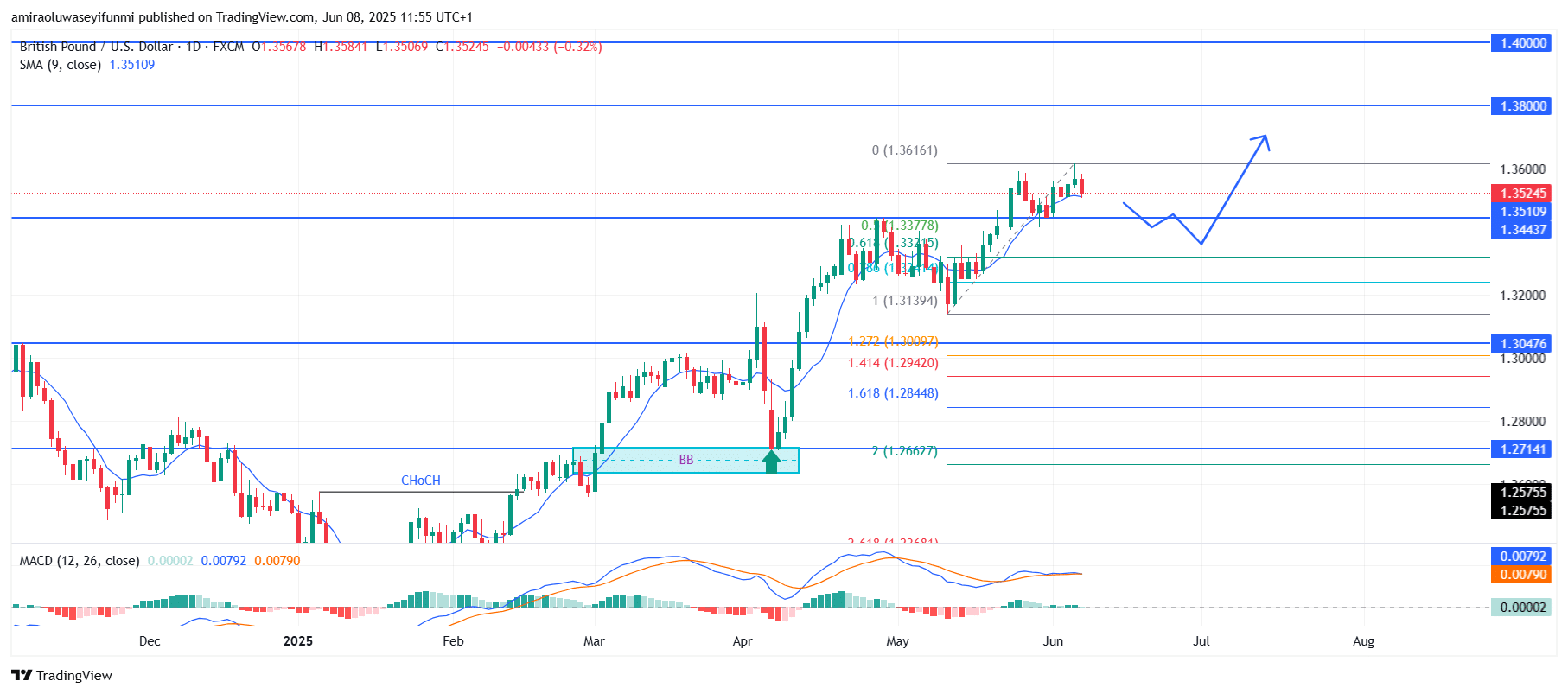

GBPUSD faces a period of temporary weakness before momentum for a bullish continuation resumes. Technical indicators suggest a possible short-term cooling in buying pressure. Although the MACD remains in bullish territory, the convergence of the MACD line (blue) with the signal line (orange) indicates weakening momentum, potentially signaling an impending retracement. The 9-day Simple Moving Average (SMA), currently situated at $1.3510, continues to act as dynamic support; however, a close below this level may trigger short-lived bearish sentiment.

GBPUSD Key Levels

Supply Levels: $1.3440, $1.3800, $1.4000

Demand Levels: $1.3140, $1.3050, $1.2710

GBPUSD Long-Term Trend: Bullish

GBPUSD has maintained a steady bullish path following a confirmed Change of Character (CHoCH) near the $1.2700 zone, with the price breaking above critical resistance levels at $1.3140 and $1.3330. However, the pair is now consolidating just below the Fibonacci extension at $1.3620, suggesting potential exhaustion. This level aligns with a significant resistance area, while minor supports at $1.3440 and $1.3330 coincide with the 0.618 and 0.786 Fibonacci retracement zones.

Given current price behavior, GBPUSD may experience a pullback toward the $1.3440 region before resuming its bullish drive. If support holds in that area, a continuation toward $1.3620 becomes increasingly likely, with further upside targeting $1.3800 and eventually $1.4000. While short-term corrections may occur, the overall trend favors long positions on pullbacks. Traders can monitor forex signals to identify optimal re-entry points during such retracements.

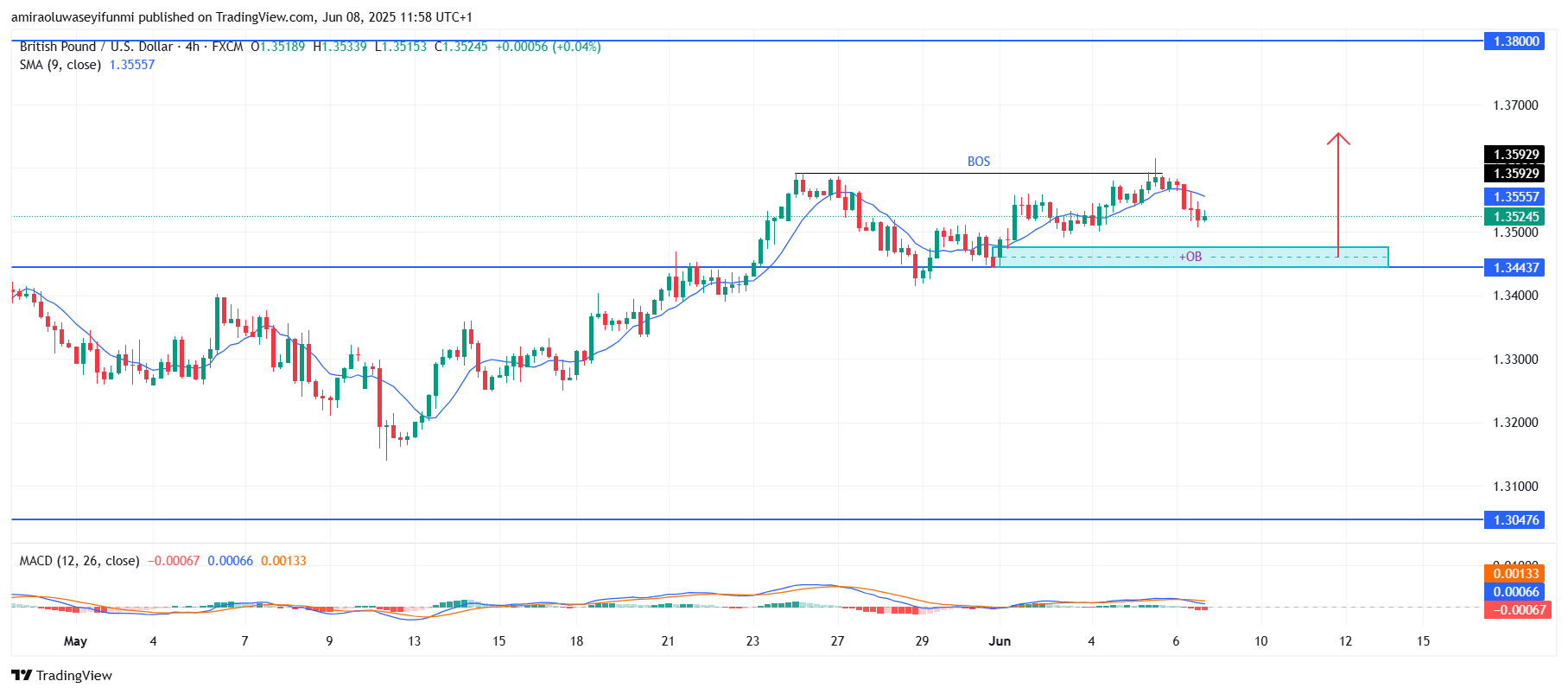

GBPUSD Short-Term Trend: Bullish

GBPUSD maintains bullish potential on the 4H chart following a Break of Structure (BOS) and a price retracement into a defined Order Block (OB). The 9-period SMA currently serves as dynamic resistance, but a strong rebound from the OB could spark continued bullish movement.

The MACD is slightly bearish yet nearing a crossover, suggesting a possible shift in momentum. A confirmed break above $1.3560 could propel the price toward the $1.3590 and $1.3800 resistance levels.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.