Market Analysis – July 28

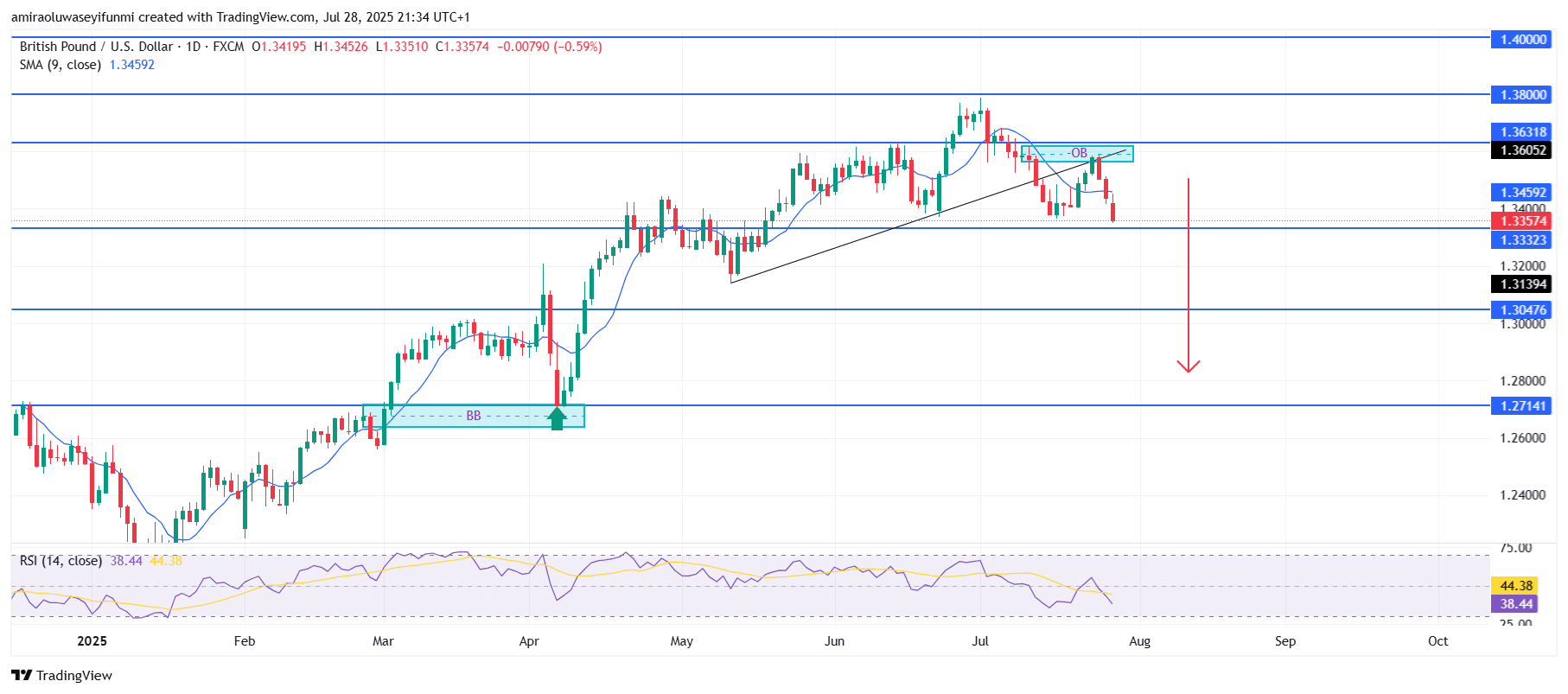

GBPUSD is experiencing downside pressure following a key structural breakdown. The pair has resumed its bearish momentum, as price has decisively dropped below the 9-day Simple Moving Average (SMA), currently positioned at $1.3460. This breakdown aligns with fading bullish strength, reflected in the Relative Strength Index (RSI), which has slipped below the midpoint to 38.44. The RSI also confirms the bearish divergence noted from recent price highs, while the overall market structure suggests a failure to maintain higher highs after testing resistance around $1.3630.

GBPUSD Key Levels

Supply Levels: $1.3630, $1.3800, $1.4000

Demand Levels: $1.3330, $1.3050, $1.2710

GBPUSD Long-Term Trend: Bearish

From a technical perspective, the price recently broke below a clearly defined ascending trendline and faced rejection at the order block (OB) near $1.3610. This rejection confirms the shift in market sentiment, as buyers were unable to hold the prior bullish base above $1.3450. The breakdown of this zone, followed by sustained selling, confirms a lower high formation, establishing the beginning of a bearish market structure. Price is now retesting former support at $1.3330, with sellers likely to defend against any short-term rebounds.

Looking forward, GBPUSD appears set for continued downside, particularly if bearish momentum holds below $1.3330. A decisive drop beneath this level would reveal intermediate support at $1.3140, followed by the $1.3050 region, where selling pressure might temporarily ease. However, if downward momentum remains strong, a deeper retracement toward $1.2710 is possible in the coming weeks. Unless bullish strength recovers above $1.3460, the broader market outlook remains skewed in favor of sellers. Traders may find valuable insights through the use of forex signals to navigate such volatile conditions.

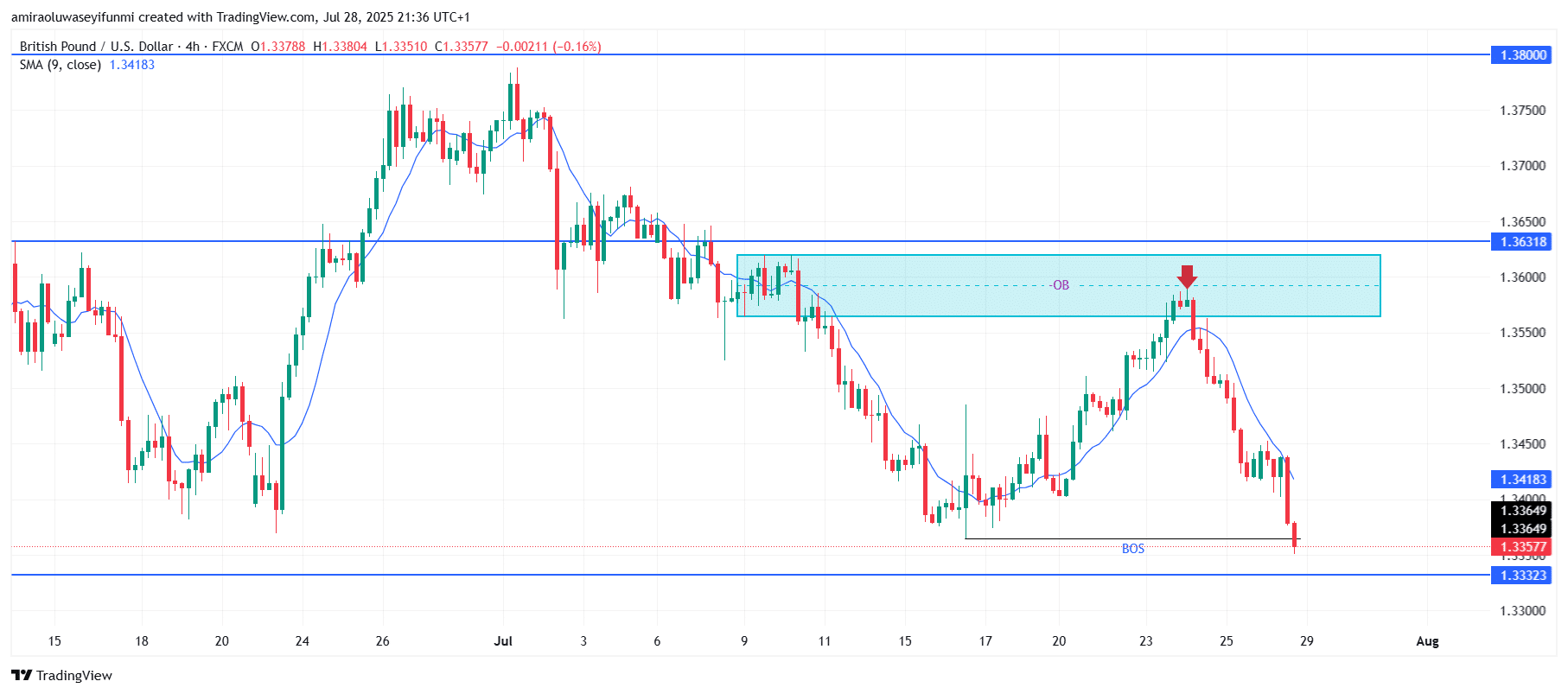

GBPUSD Short-Term Trend: Bearish

On the four-hour chart, GBPUSD continues to trade bearishly after rejecting the $1.3630 supply zone marked by the order block (OB). Price reacted strongly to this bearish OB, triggering a notable downward move. It has now broken below the structure identified as BOS, reinforcing the continuation of the bearish trend. With the 9-period SMA positioned above current price and bearish momentum intensifying, a further decline toward $1.3330 seems probable.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.