Market Analysis – September 4th

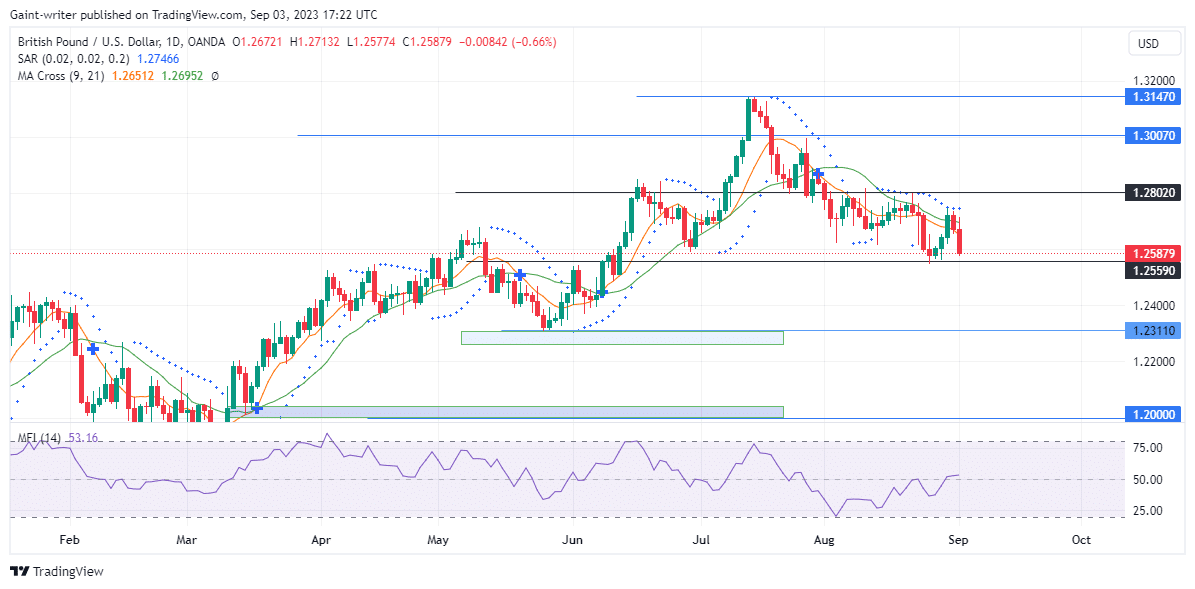

GBPUSD bears maintain control as selling pressure intensifies. The pair has experienced a decline as sellers continue to put in more effort on the market. The bears have successfully pushed the price below the 1.25590 market level. This already indicates their dominance. It suggests that the selling pressure could potentially drive the pair even lower.

l

The buyers failed to breach the strong resistance at the 1.31470 key level. This resistance zone acted as a major obstacle to buying liquidity, contributing to the continuation of the bearish trend.

GBPUSD Key Zones:

Resistance Zones: 1.31470, 1.30070

Support Zones: 1.28020, 1.23110

GBPUSD Long-Term Trend: Bearish

The sellers fought back and managed to channel the price lower in the market. The persistence of selling pressure implies that bearish sentiment will likely influence the new week. This suggests that buyers are losing their influence on the GBPUSD pair, creating a favorable environment for sellers.

l

The Money Flow Index indicator currently stands at the mid-range level of 50. This signifies a balanced market sentiment, with neither buyers nor sellers having a clear advantage. However, sellers need to raise the bar and intensify their selling pressure to gain more control over the market.

l

The Parabolic SAR indicator remains on a bearish trajectory, supporting the ongoing decline in the GBPUSD pair. This indicator helps identify potential reversal points in the market and, in this case, reinforces the bearish sentiment. Traders should closely monitor the response of the Parabolic (Stop and Reverse) on the daily chart for further insights.

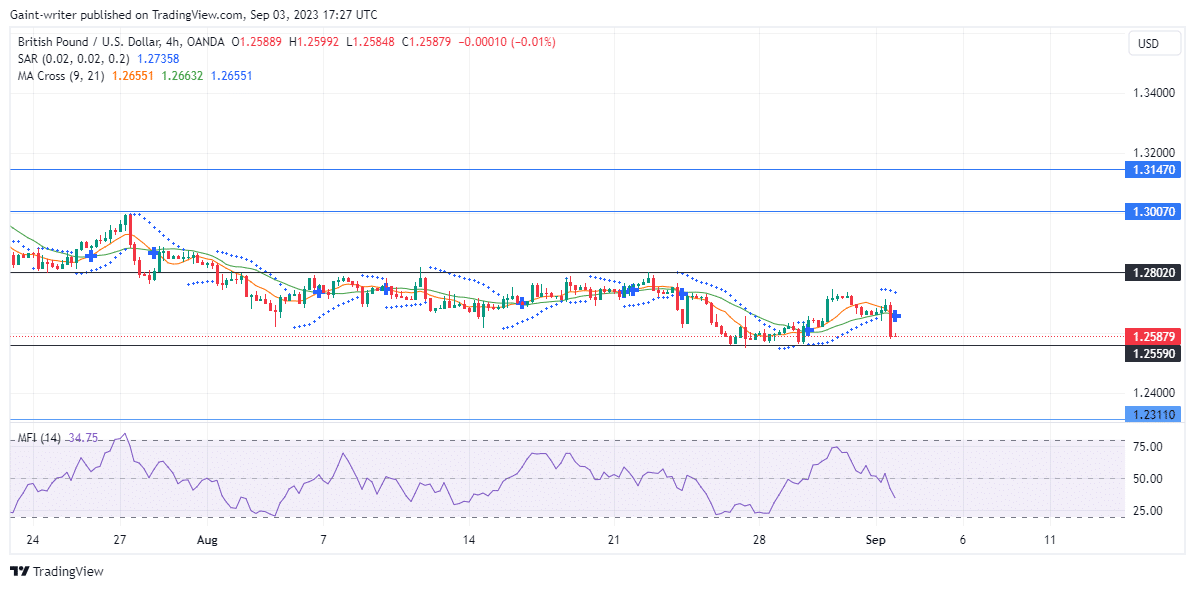

GBPUSD Short-Term Trend: Bearish

Last week ended with sellers maintaining their bearish stance. The lack of attraction from buyers resulted in a low response, further strengthening the selling pressure. It appears that sell-side traders are determined to push the price beyond the 1.25590 key level.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.