Market Analysis – January 27

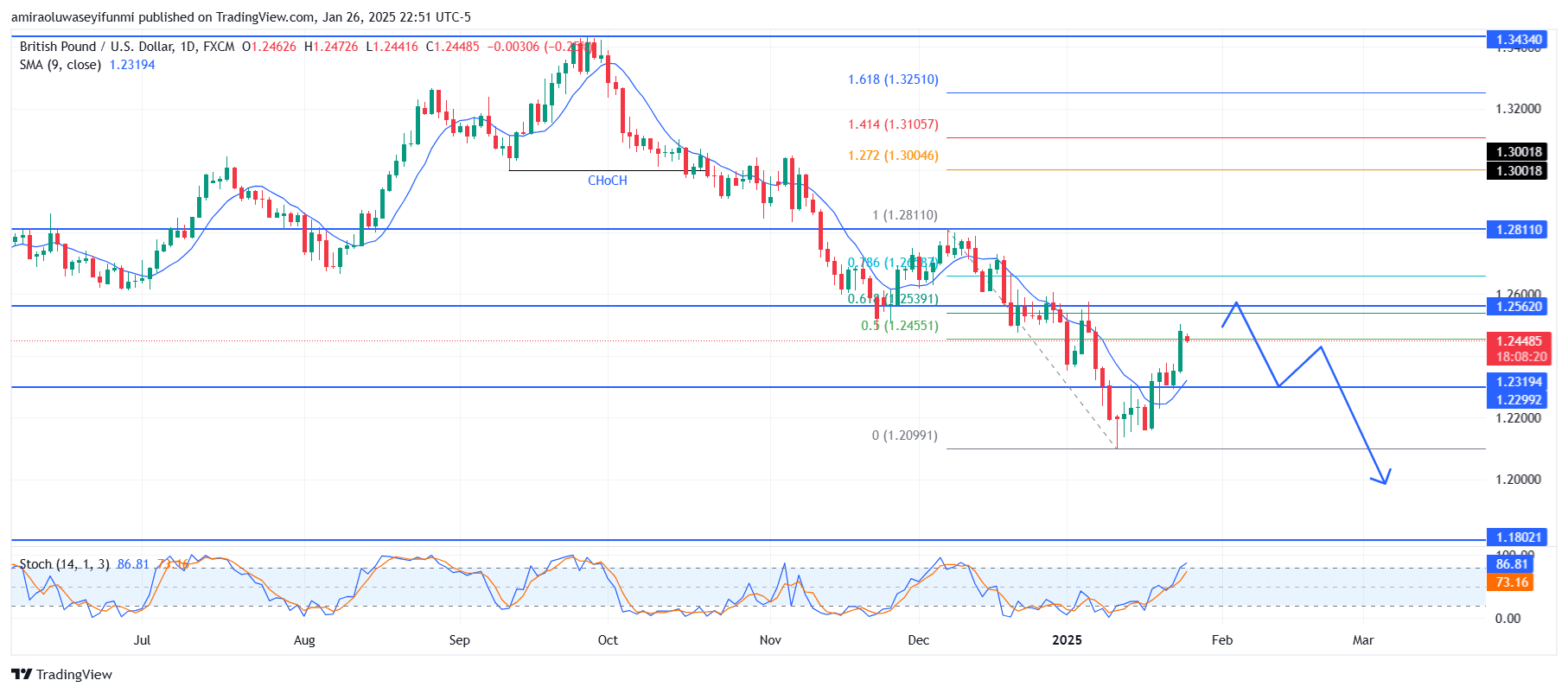

GBPUSD analysis suggests the possibility of further declines ahead. The indicators on the chart point to prevailing bearish momentum. The 9-day simple moving average (SMA) at $1.23190 is trending below the current price of $1.24480, signaling a potential pullback before resuming the downward trend. The Stochastic Oscillator shows overbought conditions, with values at 86.78 and 73.16, reinforcing the probability of a near-term price correction. These technical signals align with the broader bearish sentiment.

GBPUSD Key Levels

Supply Levels: $1.25760, $1.28110, $1.34340

Demand Levels: $1.23000, $1.21000, $1.18020

GBPUSD Long-Term Trend: Bearish

The price action indicates a significant rejection near the $1.25620 resistance level, creating a lower high. The bearish change of character (CHoCH) near $1.28110 highlights a shift in market structure. The pair has also retraced close to the 0.786 Fibonacci level at $1.25390 but failed to breach it, further confirming sellers’ control. A breakdown below the $1.23000 support level would strengthen the bearish scenario.

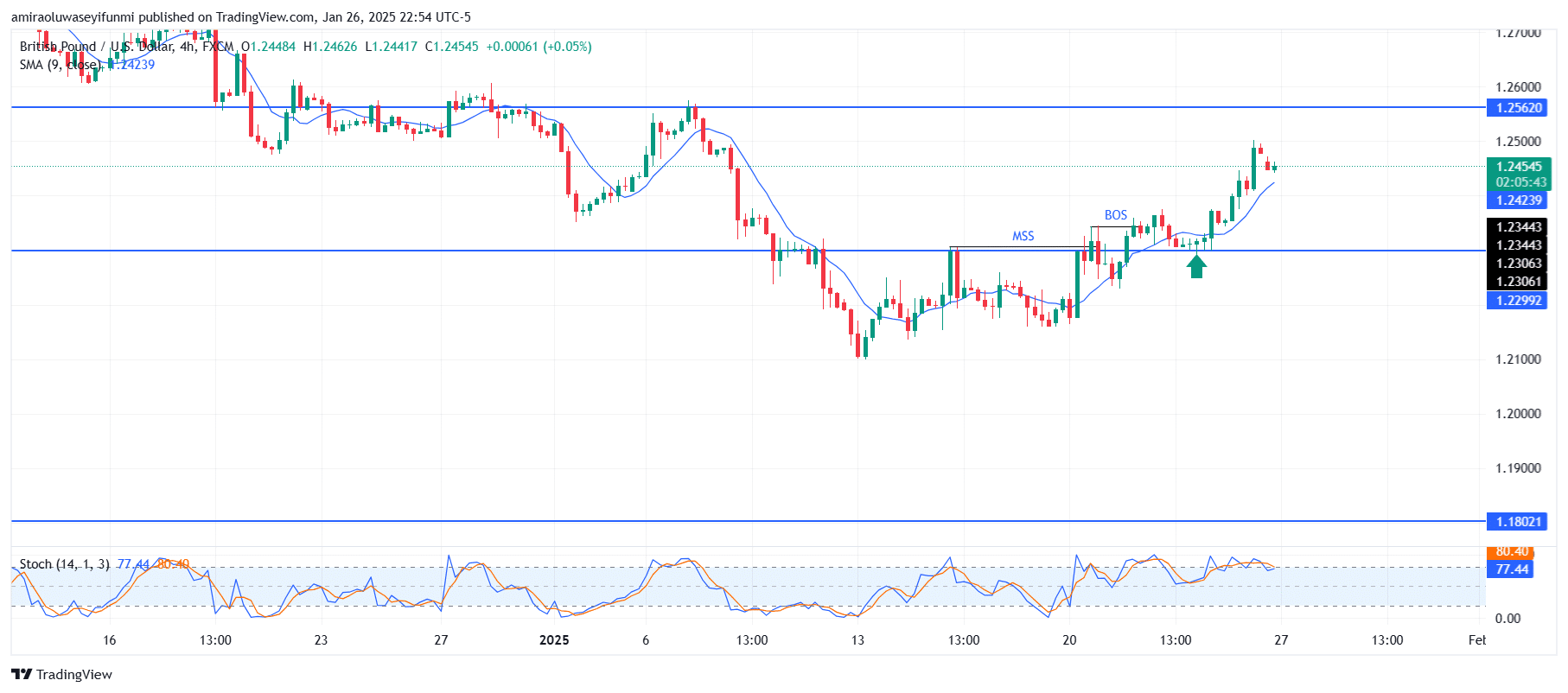

GBPUSD Short-Term Trend: Bullish

The direction of GBPUSD is bullish on the lower timeframe, with the price trading above the 9-period SMA at $1.24240, indicating strong upward momentum. A breakout above the recent market structure shift (MSS) around $1.23440 confirms the bullish bias. The Stochastic Oscillator is in the overbought region, suggesting potential consolidation or a minor pullback. The next resistance level is at $1.25620, while $1.24240 serves as immediate support to maintain the bullish structure on the four-hour chart.

For traders seeking insights on market movements, following forex signals can be an essential tool for effective decision-making in volatile markets.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.