GBPJPY Price Analysis – May 31

Traders might sustain a selling bias on GBPJPY in the expectation that the pound weakness may extend more in the near term. As the cross tends to stay at 133.00, around the level. Negative Brexit news tends to weaken the pound, with persistent rumors that the BoE (Bank of England) may hold out negative rates.

Key Levels

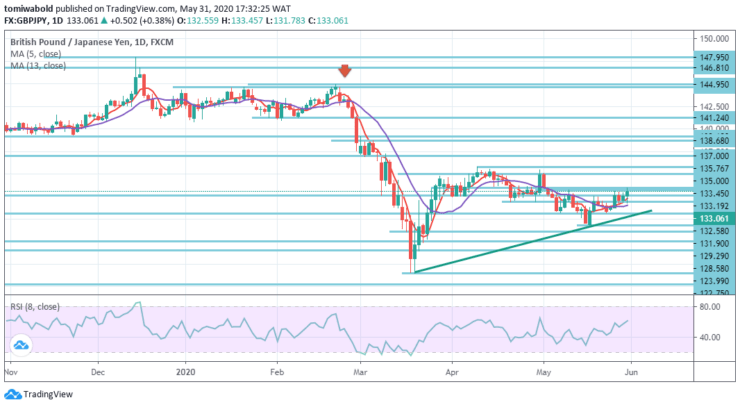

Resistance Levels: 147.95, 138.68, 135.00

Support Levels: 131.90, 126.54, 123.99

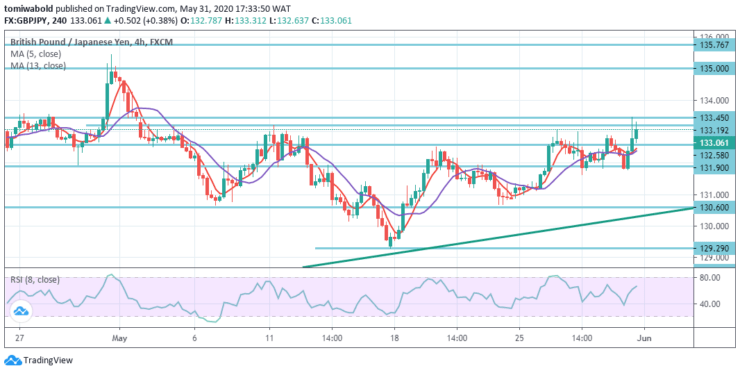

The GBP has persisted to perform poorly during the last week. GBPJPY tested the resistance at a level of 133.19 but did not break beyond during the first attempt, however, a second and more positive move came through after a slight correction.

lA breach over key-resistance at 133.19 further shifted the potential alternative level to the ideal target, and this result looks probable towards a 135.00 level of significant resistance. Nevertheless, the potential downside is intended to push out as long as the level of resistance stays intact at 147.95 level.

Despite attempting one more time to pull beyond the level of resistance of 133.45, GBPJPY stays tight as May ends. While the general trend appears bearish, sellers may aim for a split underneath the level of 132.58 with the prospect of collapse towards the levels of 131.90 and 130.60.

In comparison, the spot is expected to face heavy resistance near the level of 133.45. Initial bias for a resistance level of 135.76 is now on the upside this week. A split there will trigger the entire growth from 123.99 to 135.76 from 129.29 at 137.00 levels for a forecast of 61.8 percent.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.