GBPJPY Price Analysis – April 1

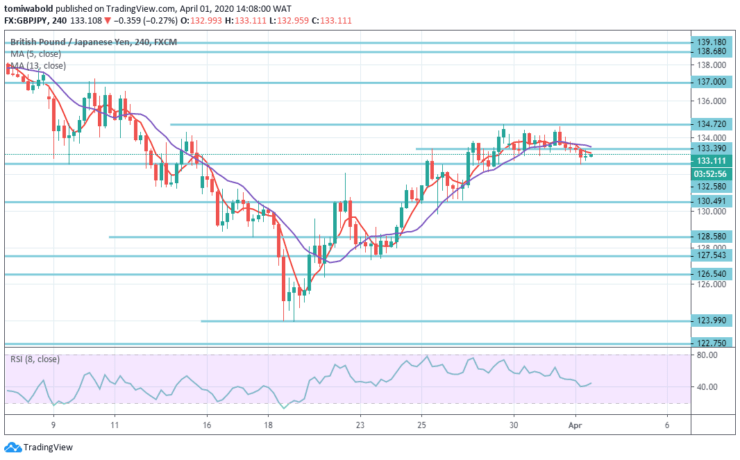

The FX cross is presently stalled close to 134.00 sub-levels, for the 4th consecutive day in a row, having attempted to take out the price at 134.72 level. The Pound was under tension because Fitch reduced its UK long-term issuer default ratings to AA- from AA, noting the deterioration of UK public spending in the wake of the COVID-19 turmoil and the controversy over the post-Brexit trade deal with the EU.

Key Levels

Resistance Levels: 147.95, 138.68, 134.72

Support Levels: 130.49, 127.54, 122.75

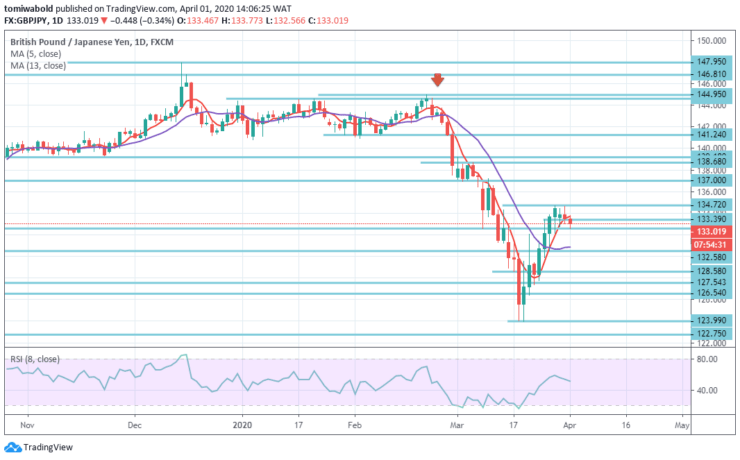

GBPJPY Long term Trend: Ranging

In the broader context, the current trajectory indicates that market behavior at the level of 122.75 (low) is merely a side-by-side consolidation trend that has been finished at 147.95 level. Bigger downward trend from level 195.86 (high) level and that from the level at 251.09 (high) are probable to continue.

The 122.75 level break may approach the 195.86 to 122.75 projection of 61.8 percent from 147.95 to 102.76 next levels. The pattern may, in either event, stay bearish as long as the resistance level of 147.95 stays intact.

GBPJPY Short term Trend: Ranging

GBPJPY intraday bias remains optimistic, and the pattern remains unchanged. Another advance could well be expected, but the upside may be contained by retracing 61.8 percent from 144.95 to 123.94 at 136.92 levels to resume falling.

On the downside, breakage of 128.58 minor support level that initially usher in the low level of 123.99 reattempts. Nevertheless, the constant break of level 134.72 may increase the likelihood of trend reversal and move focus to the level of resistance at 144.95.

Instrument: GBPJPY

Order: Sell

Entry price: 133.39

Stop: 134.72

Target: 132.50

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.